International Monetary Fund

Its stated mission is "working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world.

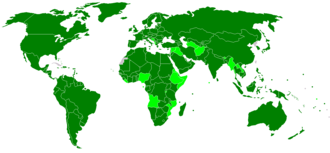

"[1][9] Established in July 1944[10] at the Bretton Woods Conference, primarily according to the ideas of Harry Dexter White and John Maynard Keynes, it started with 29 member countries and the goal of reconstructing the international monetary system after World War II.

[18] Detractors argue that its interventions often prioritize the stability of financial institutions over individual economic freedoms, restricting the ability of local markets to self-correct and develop organically.

[19][20] Additionally, its governance structure disproportionately favors wealthier nations, particularly the United States, raising concerns about undue political influence in the global financial system.

[31] Since the demise of the Bretton Woods system of fixed exchange rates in the early 1970s, surveillance has evolved largely by way of changes in procedures rather than through the adoption of new obligations.

[30] For instance, The IMF played a significant role in individual countries, such as Armenia and Belarus, in providing financial support to achieve stabilization financing from 2009 to 2019.

[35] The executive board approved the SDDS and GDDS in 1996 and 1997, respectively, and subsequent amendments were published in a revised Guide to the General Data Dissemination System.

[41] Conditionality also reassures the IMF that the funds lent to them will be used for the purposes defined by the Articles of Agreement and provides safeguards that the country will be able to rectify its macroeconomic and structural imbalances.

[39] As of 2004[update], borrowing countries have had a good track record for repaying credit extended under the IMF's regular lending facilities with full interest over the duration of the loan.

American delegate Harry Dexter White foresaw an IMF that functioned more like a bank, making sure that borrowing states could repay their debts on time.

British economist John Maynard Keynes, on the other hand, imagined that the IMF would be a cooperative fund upon which member states could draw to maintain economic activity and employment through periodic crises.

[67] In the October 2013, Fiscal Monitor publication, the IMF suggested that a capital levy capable of reducing Euro-area government debt ratios to "end-2007 levels" would require a very high tax rate of about 10%.

[68] The Fiscal Affairs department of the IMF, headed at the time by Acting Director Sanjeev Gupta, produced a January 2014 report entitled "Fiscal Policy and Income Inequality" that stated that "Some taxes levied on wealth, especially on immovable property, are also an option for economies seeking more progressive taxation ... Property taxes are equitable and efficient, but underutilized in many economies ...

[84] Former members are Cuba (which left in 1964),[85] and Taiwan, which was ejected from the IMF[86] in 1980 after losing the support of the then United States President Jimmy Carter and was replaced by the People's Republic of China.

Joseph Stiglitz argues, "There is a need to provide more effective voice and representation for developing countries, which now represent a much larger portion of world economic activity since 1944, when the IMF was created.

[67] The staff was directed to formulate an updated policy, which was accomplished on 22 May 2014 with a report entitled "The Fund's Lending Framework and Sovereign Debt: Preliminary Considerations", and taken up by the executive board on 13 June.

[144] Overseas Development Institute (ODI) research undertaken in 1980 included criticisms of the IMF which support the analysis that it is a pillar of what activist Titus Alexander calls global apartheid.

[149] The crisis added to widespread hatred of this institution in Argentina and other South American countries, with many blaming the IMF for the region's economic problems.

[150] In an interview (2008-05-19), the former Romanian Prime Minister Călin Popescu-Tăriceanu claimed that "Since 2005, IMF is constantly making mistakes when it appreciates the country's economic performances".

[159] The recipient governments are sacrificing policy autonomy in exchange for funds, which can lead to public resentment of the local leadership for accepting and enforcing the IMF conditions.

[160] It is claimed that conditionalities hinder social stability and hence inhibit the stated goals of the IMF, while Structural Adjustment Programmes lead to an increase in poverty in recipient countries.

[171][172] The role of the Bretton Woods institutions has been controversial since the late Cold War, because of claims that the IMF policy makers supported military dictatorships friendly to American and European corporations, but also other anti-communist and Communist regimes, such as Socialist Republic of Romania.

[184] The IMF is only one of many international organisations, and it is a generalist institution that deals only with macroeconomic issues; its core areas of concern in developing countries are very narrow.

One proposed reform is a movement towards close partnership with other specialist agencies such as UNICEF, the Food and Agriculture Organization (FAO), and the United Nations Development Programme (UNDP).

He also notes that IMF loan conditions should be paired with other reforms—e.g., trade reform in developed nations, debt cancellation, and increased financial assistance for investments in basic infrastructure.

[21] The U.S. has historically been openly opposed to losing what Treasury Secretary Jacob Lew described in 2015 as its "leadership role" at the IMF, and the U.S.' "ability to shape international norms and practices".

Raúl Prebisch, the founding secretary-general of the UN Conference on Trade and Development (UNCTAD), wrote that one of "the conspicuous deficiencies of the general economic theory, from the point of view of the periphery, is its false sense of universality".

[201] Managing Director Lagarde (2011–2019) was convicted of giving preferential treatment to businessman-turned-politician Bernard Tapie as he pursued a legal challenge against the French government.

[202] Within hours of her conviction, in which she escaped any punishment, the fund's 24-member executive board put to rest any speculation that she might have to resign, praising her "outstanding leadership" and the "wide respect" she commands around the world.

Portuguese musician José Mário Branco's 1982 album FMI [pt] is inspired by the IMF's intervention in Portugal through monitored stabilisation programs in 1977–78.