Financialization

Financialization may permit real goods, services, and risks to be readily exchangeable for currency, and thus make it easier for people to rationalize their assets and income flows.

Various definitions, focusing on specific aspects and interpretations, have been used: Jean Cushen explores how the workplace outcomes associated with financialization render employees insecure and angry.

[6] In the American experience, increased financialization occurred concomitant with the rise of neoliberalism and the free-market doctrines of Milton Friedman and the Chicago School of Economics in the late twentieth century.

Various academic economists of that period worked out ideological and theoretical rationalizations and analytical approaches to facilitate the increased deregulation of financial systems and banking.

What are the long-term consequences if an increasing percentage of savings and wealth, as it now seems, is used to inflate the prices of already existing assets - real estate and stocks - instead of to create new production and innovation?

The combined turnover of interest rate, currency and stock index derivatives fell by 7% to $431 trillion between October and December 2006.

Thus, derivatives trading—mostly futures contracts on interest rates, foreign currencies, Treasury bonds, and the like—had reached a level of $1,200 trillion, or $1.2 quadrillion, a year.

The figures for earlier years were estimated on the computer-generated exponential fit of data from 1960 to 1970, with 1960 set at $165 billion, half the 1970 figure, based on a graph accompanying the ACLI data, which showed that the number of futures contracts traded in 1961 and earlier years was about half the number traded in 1970.

(Beginning in mid-1993, the Chicago Mercantile Exchange itself began to release figures of the nominal value of contracts traded at the CME each month.

In November 1993, the CME boasted that it had set a new monthly record of 13.466 million contracts traded, representing a dollar value of $8.8 trillion.

Another mitigating factor to consider is that a commonly traded liquid asset, such as gold, wheat, or the S&P 500 stock index, is extremely unlikely to have a future value of $0; thus the counter-party risk is limited to something substantially less than the nominal value.

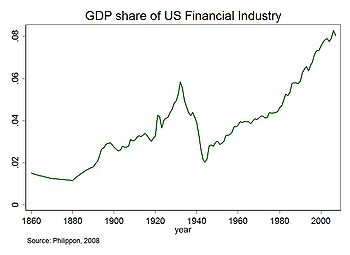

The financial sector is a key industry in developed economies, in which it represents a sizable share of the GDP and an important source of employment.

In an article entitled "Our Financial Oligarchy," Louis Brandeis, who in 1913 was appointed to the United States Supreme Court, wrote that "We believe that no methods of regulation ever have been or can be devised to remove the menace inherent in private monopoly and overwhelming commercial power" that is vested in U.S. finance sector firms.

[11] Key players of financial sector firms also had a seat at the table in devising the central bank of the United States.

In November 1910 the five heads of the country's most powerful finance sector firms gathered for a secret meeting on Jekyll Island with U.S.

Senator Nelson W. Aldrich and Assistant Secretary of the U.S. Treasury Department A. Piatt Andrew and laid the plans for the U.S. Federal Reserve System.

[15] U.S. federal deregulation in the 1980s of many types of banking practices paved the way for the rapid growth in the size, profitability and political power of the financial sector.

The difficulty of determining exactly how much this swap contract is worth, when accounted for on a financial institution's books, is typical of the worries of many experts and regulators over the explosive growth of these types of instruments.

[citation needed] Contrary to common belief in the United States, the largest financial center for derivatives (and for foreign exchange) is London.

[24] Bruce Bartlett summarized several studies in a 2013 article indicating that financialization has adversely affected economic growth and contributes to income inequality and wage stagnation for the middle class.

"[26] Some, such as former International Monetary Fund chief economist Simon Johnson, have argued that the increased power and influence of the financial services sector had fundamentally transformed American politics, endangering representative democracy itself through undue influence on the political system and regulatory capture by the financial oligarchy.

[27] In the 1990s vast monetary resources flowing to a few "megabanks," enabled the financial oligarchy to achieve greater political power in the United States.