Fixed cost

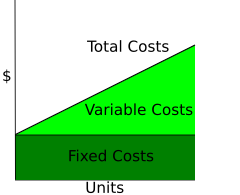

This is in contrast to variable costs, which are volume-related (and are paid per quantity produced) and unknown at the beginning of the accounting year.

As another example, for a bakery the monthly rent and phone line are fixed costs, irrespective of how much bread is produced and sold; on the other hand, the wages are variable costs, as more workers would need to be hired for the production to increase.

This distinction is crucial in forecasting the earnings generated by various changes in unit sales and thus the financial impact of proposed marketing campaigns.

In a survey of nearly 200 senior marketing managers, 60 percent responded that they found the "variable and fixed costs" metric very useful.

For example, a company may have unexpected and unpredictable expenses unrelated to production, such as warehouse costs and the like that are fixed only over the time period of the lease.

[2][3] Investments in facilities, equipment, and the basic organization that cannot be significantly reduced in a short period of time are referred to as committed fixed costs.

Examples of discretionary costs are advertising, insurance premia, machine maintenance, and research & development expenditures.

It is difficult to adjust human resources according to the actual work needs in short term.