Fund accounting

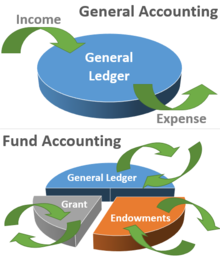

Nonprofit organizations and government agencies have special requirements to show, in financial statements and reports, how money is spent, rather than how much profit was earned.

Examples include legal requirements, where the moneys can only be lawfully used for a specific purpose, or a restriction imposed by the donor or provider.

[7] When using the fund accounting method, an organization is able to therefore separate the financial resources between those immediately available for ongoing operations and those intended for a donor specified reason.

This also provides an audit trail that all moneys have been spent for their intended purpose and thereby released from the restriction.

Each of these programs has its own unique reporting requirements, so the school system needs a method to separately identify the related revenues and expenditures.

Nonprofit organization's finances are broken into two primary categories, unrestricted and restricted funds.

Non-program supporting services include the costs of fund-raising events, management and general administration.

They are produced using the annual basis and generated under the International Financial Reporting Standards like any other large organisation.

[25] Fiduciary funds are used to account for assets held in trust by the government for the benefit of individuals or other entities.

(Cash basis accounting, used by some small businesses, recognizes revenue when received and expenses when paid.)

Expenditures, a term preferred over expenses for modified accrual accounting, are recognized when the related liability is incurred.

[39][40] Expenditures also include purchases of capital assets, and repayments of debt, which are not considered expenses in business accounting.

If the trust involves a business-like operation, accrual basis accounting would be appropriate to show the fund's profitability.

Since making a profit is not the purpose of a government, a significant surplus generally means a choice between tax cuts or spending increases.

Except for the unified budget deficit, the federal government's financial statements rely on accrual basis accounting.

For Fiscal Year 2009, which began on July 1, 2008, the Mayor's Office estimated general fund revenues of $35 million from property taxes, state grants, parking fines and other sources.

In the example above, the city can spend as much as $34 million, but smaller appropriation limits have also been established for individual programs and departments.

[39][40] The Public Works Department spent $1 million on supplies and services for maintaining city streets.

City government agencies are not allowed to spend the unexpended balance, even if their expenditures during the now-ended fiscal period were less than their share of the expired appropriation.

(Liabilities incurred at the end of the fiscal period for goods and services ordered, but not yet received, are usually considered expended, allowing payment at a later date under the current appropriation.