Depreciation

Depreciation is any method of allocating such net cost to those periods in which the organization is expected to benefit from the use of the asset.

Depreciation is technically a method of allocation, not valuation,[4] even though it determines the value placed on the asset in the balance sheet.

If an asset is expected to produce a benefit in future periods, some of these costs must be deferred rather than treated as a current expense.

The business then records depreciation expense in its financial reporting as the current period's allocation of such costs.

Accounting rules also require that an impairment charge or expense be recognized if the value of assets declines unexpectedly.

Many companies consider write-offs of some of their long-lived assets because some property, plant, and equipment have suffered partial obsolescence.

The steps to determine are: Depletion and amortization are similar concepts for natural resources (including oil) and intangible assets, respectively.

However, since depreciation is an expense to the P&L account, provided the enterprise is operating in a manner that covers its expenses (e.g., operating at a profit) depreciation is a source of cash in a statement of cash flows, which generally offsets the cash cost of acquiring new assets required to continue operations when existing assets reach the end of their useful lives.

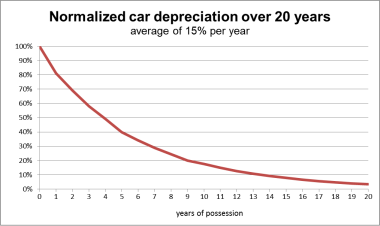

There are several methods for calculating depreciation, generally based on either the passage of time or the level of activity (or use) of the asset.

Straight-line method: DE=(Cost-SL)/UL For example, a vehicle that depreciates over 5 years is purchased at a cost of $17,000 and will have a salvage value of $2000.

In addition, this gain above the depreciated value would be recognized as ordinary income by the tax office.

The double-declining-balance method is also a better representation of how vehicles depreciate and can more accurately match cost with benefit from asset use.

In the end, the sum of accumulated depreciation and scrap value equals the original cost.

The composite method is applied to a collection of assets that are not similar and have different service lives.

Theoretically, this makes sense because the gains and losses from assets sold before and after the composite life will average themselves out.

The cost of assets not currently consumed generally must be deferred and recovered over time, such as through depreciation.

Some systems permit the full deduction of the cost, at least in part, in the year the assets are acquired.

[10] A common system is to allow a fixed percentage of the cost of depreciable assets to be deducted each year.

Deductions are permitted to individuals and businesses based on assets placed in service during or before the assessment year.

The fixed percentage is multiplied by the tax basis of assets in service to determine the capital allowance deduction.

Some systems specify lives based on classes of property defined by the tax authority.

Canada Revenue Agency specifies numerous classes based on the type of property and how it is used.

Under the United States depreciation system, the Internal Revenue Service publishes a detailed guide which includes a table of asset lives and the applicable conventions.

[11] IRS tables specify percentages to apply to the basis of an asset for each year in which it is in service.

Many systems allow an additional deduction for a portion of the cost of depreciable assets acquired in the current tax year.

Many tax systems prescribe longer depreciable lives for buildings and land improvements.

Many such systems, including the United States, permit depreciation for real property using only the straight-line method, or a small fixed percentage of the cost.

However, many tax systems permit all assets of a similar type acquired in the same year to be combined in a "pool".

United States rules require a mid-quarter convention for per property if more than 40% of the acquisitions for the year are in the final quarter.

In many countries, for the purpose of tax, a fixed rate is deemed for a class of asset at which rate the depreciation is to be charged and claimed as expense in profit and loss account for the purpose of tax expense allowance.