Funding

[citation needed] Sources of funding include credit, venture capital, donations, grants, savings, subsidies, and taxes.

Funding that facilitates the exchange of equity ownership in a company for capital investment via an online funding portal per the Jumpstart Our Business Startups Act (alternately, the "JOBS Act of 2012") (U.S.) is known as equity crowdfunding.

Entrepreneurs with a business concept would want to accumulate all the necessary resources including capital to venture into a market.

Funding is part of the process, as some businesses would require large start-up sums that individuals would not have.

Fund management companies gather pools of money from many investors and use them to purchase securities.

Government funding is often aimed at promoting public policies or supporting economic growth and development.

The funds they provide can be a one-time investment to help the business get off the ground or an ongoing injection to support and carry the company through its difficult early stages.

Venture capital is a type of private equity and a form of financing that is provided by firms or funds to small, early-stage, emerging firms that are deemed to have high growth potential or which have demonstrated high growth.

Grants are funds provided by one party, often a government department, corporation, foundation, or trust, to a recipient, typically a nonprofit entity, educational institution, business, or individual.

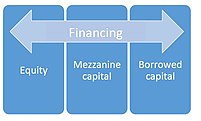

Equity financing is essentially the sale of an ownership interest to raise funds for business purposes.

One form of guarantee creates a conditional liability to make a payment, whereby the guarantor will pay the principal debt holder fails to do so.

[8] Econometric evidence shows public grants for firms can create additionality in jobs, sales, value added, innovation and capital.

Supported projects may include funding for scientific research, infrastructure development, public health initiatives, and education programs.

Unlike interest-free loans, grants do not need to be repaid, making them an attractive funding option for businesses looking to reduce financial risk.

[15] If returns do not meet the intended level, this could reduce the willingness of investors to invest their money into the funds.

Hence, the amounts of financial incentives are highly weighted determinants to ensure the funding remains at a desirable level.

Venture Capital (VC) is a subdivision of Private Equity wherein external investors fund small-scale startups that have high growth potential in the long run.

Proponents of SOFA argue that it would result in similar distribution of funding as the present grant system, but with less overhead.

[19] The use of IP as collateral in IP-backed finance transactions is the subject of a report series at the World Intellectual Property Organization.