Investment

In biotechnology, for example, investors look for big profits on companies that have small market capitalizations but can be worth hundreds of millions quite quickly.

[1] The risk is high because approximately 90% of biotechnology products researched do not make it to market due to regulations and the complex demands within pharmacology as the average prescription drug takes 10 years and US$2.5 billion worth of capital.

Value investors employ accounting ratios, such as earnings per share and sales growth, to identify securities trading at prices below their worth.

Graham and Dodd's seminal work, Security Analysis, was written in the wake of the Wall Street Crash of 1929.

A stock with a lower P/E ratio will cost less per share than one with a higher P/E, taking into account the same level of financial performance; therefore, it essentially means a low P/E is the preferred option.

[6] An instance in which the price to earnings ratio has a lesser significance is when companies in different industries are compared.

In the process of the P/B ratio, the share price of a stock is divided by its net assets; any intangibles, such as goodwill, are not taken into account.

It is a crucial factor of the price-to-book ratio, due to it indicating the actual payment for tangible assets and not the more difficult valuation of intangibles.

[7] Growth investors seek profits through capital appreciation – the gains earned when a stock is sold at a higher price than what it was purchased for.

[8] According to Investopedia author Troy Segal and U.S. Department of State Fulbright fintech research awardee Julius Mansa, growth investing is best suited for investors who prefer relatively shorter investment horizons, higher risks, and are not seeking immediate cash flow through dividends.

Price asserted that investors could reap high returns by "investing in companies that are well-managed in fertile fields.

Stocks or securities purchased for momentum investing are often characterized by demonstrating consistently high returns for the past three to twelve months.

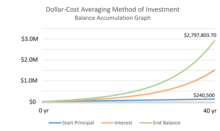

The term "dollar-cost averaging" is believed to have first been coined in 1949 by economist and author Benjamin Graham in his book, The Intelligent Investor.

Each individual investor holds an indirect or direct claim on the assets purchased, subject to charges levied by the intermediary, which may be large and varied.

High and rising free cash flow, therefore, tend to make a company more attractive to investors.