Fuel tax

[1][failed verification] Fuels used to power agricultural vehicles, as well as home heating oil which is similar to diesel, are taxed at a different, usually lower rate.

In many jurisdictions such as the United States and the European Union, commercial aviation fuel is tax free.

Taxes on transportation fuels have been advocated as a way to reduce pollution and the possibility of global warming and conserve energy.

Placing higher taxes on fossil fuels makes petrol just as expensive as other fuels such as natural gas, biodiesel or electric batteries, at a cost to the consumer in the form of inflation as transportation costs rise to transport goods all over the country.

Proponents advocate that automobiles should pay for the roads they use and argue that the user tax should not be applied to mass transit projects.

The Intergovernmental Panel on Climate Change, the International Energy Agency, the International Monetary Fund, and the World Bank have called on governments to increase gasoline tax rates in order to combat the social and environmental costs of gasoline consumption.

[2] Chinese gasoline taxes have increased the most among the top twenty CO2-emitting countries over the period 2003–2015.

Efforts by the State Council to institute a fuel tax in order to finance the National Trunk Highway System have run into strong opposition from the National People's Congress, largely out of concern for its impact on farmers.

The Central and state government's taxes make up nearly half of petrol's pump price.

The states taxes vary, but on average end up making about 17–20% of the final cost.

[10] Jet fuel tax is banned on commercial flights within the European Union, according to the 2003 Energy Taxation Directive.

[14] Recently, a rise of 23% in the diesel fuel tax has caused serious protests in major cities of France, leaving disruption and damage behind them.

[15] Before the protests, the French government expected to increase both the petrol and diesel taxes until they both reached €0.78 per liter in 2022.

As of 2022, a "maximum fuel price" has been established by the government, capped at €1.534/litre for EURO 95 petrol and at €1.498/litre for diesel since 7 January 2025.[18].

On top of that is 21% VAT over the entire fuel price, making the Dutch taxes one of the highest in the world.

Full tax rate is near 55% of motor fuel prices (ministry of industry and energy facts 2006).

Excise taxes on gasoline and diesel are collected both federal and provincial governments, as well as by some select municipalities (Montreal, Vancouver, and Victoria); with combined excise taxes varying from 16.2 ¢/L (73.6 ¢/imperial gal)) in the Yukon to 30.5 ¢/L ($1.386/imperial gal) in Vancouver.

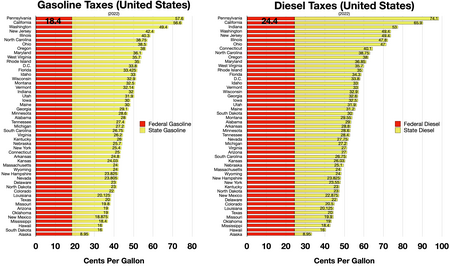

As of July 2016, twenty one states had gone ten years or more without an increase in their per-gallon gasoline tax rate.

The member jurisdictions, the US states and the CA provinces, transmit the return information to each other and settle their net tax balances with each other either by a single transmittal through a clearinghouse set up by the IFTA and operated by Morgan Stanley, or by separate transfers with the other member jurisdictions.

Diesel is not taxed at the pump, but road users with vehicles over 3.5 tonne in Gross Laden Weight and any vehicles not powered wholly by any combination of petrol, LPG or CNG must pay the Road User Charge instead.