Internal Revenue Service

It is an agency of the Department of the Treasury and led by the commissioner of Internal Revenue, who is appointed to a five-year term by the President of the United States.

[6] The IRS originates from the commissioner of internal revenue, a federal office created in 1862 to assess the nation's first income tax to fund the American Civil War.

In 1913, the Sixteenth Amendment to the U.S. Constitution was ratified, authorizing Congress to impose a tax on income and leading to the creation of the Bureau of Internal Revenue.

In 1953, the agency was renamed the Internal Revenue Service, and in subsequent decades underwent numerous reforms and reorganizations, most significantly in the 1990s.

[12] On December 4, 2024, President-elect Donald Trump announced his intention to nominate Billy Long to serve as Commissioner of the Internal Revenue Service.

[17] In 1906, with the election of President Theodore Roosevelt, and later his successor William Howard Taft, the United States saw a populist movement for tax reform.

In 1919 the IRS was tasked with enforcement of laws relating to prohibition of alcohol sales and manufacture; this was transferred to the jurisdiction of the Department of Justice in 1930.

[23] In 1952, after a series of politically damaging incidents of tax evasion and bribery among its own employees, the Bureau of Internal Revenue was reorganized under a plan put forward by President Truman, with the approval of Congress.

A White House memo said that "What we cannot do in a courtroom via criminal prosecutions to curtail the activities of some of these groups, IRS can do by administrative action.

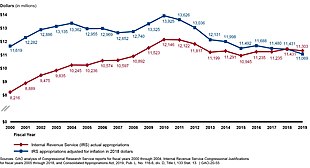

[28] In June 2012, the IRS Oversight Board recommended to Treasury a fiscal year 2014 budget of $13.074 billion for the Internal Revenue Service.

[34] By the end of the Second World War, the IRS was handling sixty million tax returns each year, using a combination of mechanical desk calculators, accounting machines, and pencil and paper forms.

[35] Information processing in the IRS systems of the late 1960s was in batch mode; microfilm records were updated weekly and distributed to regional centers for handling tax inquiries.

However, the General Accounting Office prepared a report critical of the lack of protection of privacy in TAS, and the project was abandoned in 1978.

[42] According to an inspector general's report, released in November 2013, identity theft in the United States is blamed for $4 billion worth of fraudulent 2012 tax refunds by the IRS.

Koskinen predicted the IRS would shut down operations for two days later that year which would result in unpaid furloughs for employees and service cuts for taxpayers.

[47] The following year, the IRS announced a new login and ID verification process for several of its online tools, including general account access, Identity Protection (IP) PIN setup, and payment plan applications.

[54] Congress later enacted the Internal Revenue Service Restructuring and Reform Act of 1998, which mandated that the agency replace its geographic regional divisions with units that serve particular categories of taxpayers.

[62] From May 22, 2013, to December 23, 2013, senior official at the Office of Management and Budget Daniel Werfel was acting Commissioner of Internal Revenue.

The deputy also administers and provides executive leadership for customer service, processing, tax law enforcement and financial management operations.

[70] OPR investigates suspected misconduct by attorneys, CPAs and enrolled agents ("tax practitioners") involving practice before the IRS and has the power to impose various penalties.

[72] Internal Revenue Service, Criminal Investigation (IRS-CI) is responsible for investigating potential criminal violations of the U.S. Internal Revenue Code and related financial crimes, such as money laundering, currency violations, tax-related identity theft fraud, and terrorist financing that adversely affect tax administration.

Link & Learn Taxes (searchable by keyword on the IRS website), is the free e-learning portion of VITA/TCE program for training volunteers.

[96][97][98][99] Testimony was given before a Senate subcommittee that focused on cases of overly aggressive IRS collection tactics in considering a need for legislation to give taxpayers greater protection in disputes with the agency.

[100] In 2002, the IRS accused James and Pamela Moran, as well as several others, of conspiracy, filing false tax returns and mail fraud as part of the Anderson Ark investment scheme.

[104] On September 5, 2014, 16 months after the scandal first erupted, a Senate Subcommittee released a report that confirmed that Internal Revenue Service used inappropriate criteria to target Tea Party groups, but found no evidence of political bias.

[105] The chairman of the Senate Permanent Subcommittee on Investigations confirmed that while the actions were "inappropriate, intrusive, and burdensome", the Democrats have often experienced similar treatment.

[107] On May 25, 2015, the agency announced that over several months criminals had accessed the private tax information of more than 100,000 taxpayers and stolen about $50 million in fraudulent returns.

[111][112][113] The Internal Revenue Service has been the subject of frequent criticism by many elected officials and candidates for political office, including some who have called to abolish the IRS.

[116] In 2022, Representative Matt Gaetz of Florida introduced a bill to disarm the IRS after the agency had drawn public attention for a $700,000 purchase of ammunition.

Systems such as the Individual Master File are more than 50 years old and have been identified by the Government Accountability Office as "facing significant risks due to their reliance on legacy programming languages, outdated hardware, and a shortage of human resources with critical skills".