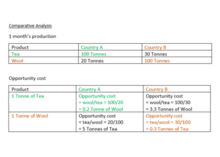

Opportunity cost

As a representation of the relationship between scarcity and choice,[2] the objective of opportunity cost is to ensure efficient use of scarce resources.

[5] This means explicit costs will always have a dollar value and involve a transfer of money, e.g. paying employees.

As implicit costs are the result of assets, they are also not recorded for the use of accounting purposes because they do not represent any monetary losses or gains.

[9] In terms of factors of production, implicit opportunity costs allow for depreciation of goods, materials and equipment that ensure the operations of a company.

We use "adjustment costs" to describe shifts in the firm's product nature rather than merely changes in output volume.

In line with the conventional concept, the adjustment costs experienced during repositioning may involve expenses linked to the reassignment of capital and/or labor resources.

As such, accounting principles focus on tangible and measurable factors associated with operating a business such as wages and rent, and thus, do not "infer anything about relative economic profitability".

As shown in the simplified example in the image, choosing to start a business would provide $10,000 in terms of accounting profits.

Several performance measures of economic profit have been derived to further improve business decision-making such as risk-adjusted return on capital (RAROC) and economic value added (EVA), which directly include a quantified opportunity cost to aid businesses in risk management and optimal allocation of resources.

[19] The discounted cash flow method has surpassed all others as the primary method of making investment decisions, and opportunity cost has surpassed all others as an essential metric of cash outflow in making investment decisions.

The money earned in the market represents the opportunity cost of the asset utilized in the business venture.

In addition, opportunity costs are employed to determine to price for asset transfers between industries.

Absolute advantage on the other hand refers to how efficiently a party can use its resources to produce goods and services compared to others, regardless of its opportunity costs.

[23] Similar to the way people make decisions, governments frequently have to take opportunity cost into account when passing legislation.

They are thereby prevented from using $840 billion to fund healthcare, education, or tax cuts or to diminish by that sum any budget deficit.

Governmental responses to the COVID-19 epidemic have resulted in considerable economic and social consequences, both implicit and apparent.

These costs, which are often simpler to measure, resulted in greater public debt, decreased tax income, and increased expenditure by the government.

The massive increase in the need for intensive care has largely limited and exacerbated the department's ability to address routine health problems.

The sector must consider opportunity costs in decisions related to the allocation of scarce resources, premised on improving the health of the population.

Patients with severe symptoms of COVID-19 require close monitoring in the ICU and in therapeutic ventilator support, which is key to treating the disease.

[27] In this case, scarce resources include bed days, ventilation time, and therapeutic equipment.

[clarification needed][25] A perfect competition model can be used to express the concept of opportunity cost in the health sector.

[clarification needed][25] The balance is Pareto optimal equals marginal opportunity cost.

[25] As a result, the opportunity cost increases when other patients cannot be admitted to the ICU due to a shortage of beds.