High-net-worth individual

[2][5] These thresholds are broadly used in studies of wealth inequality, government regulation, investment suitability requirements, marketing, financing standards, and general corporate strategy.

The United States had the highest number of HNWIs (5.5 million) of any country, with California, Texas, New York, Florida, and Illinois domiciling the majority stateside.

The Dodd-Frank Wall Street Reform Act mandates that the definition of a qualified client be reviewed every five years and adjusted for inflation.

[11] The World Wealth Report was co-published by Merrill Lynch and Capgemini, previously known as Cap Gemini Ernst & Young who worked together since 1993, investigating the "needs of high-net-worth individuals" to "successfully serve this market segment".

The World Wealth Report has estimated the number and combined investable wealth of high-net-worth individuals as follows (using the United States Consumer Price Index (CPI) Inflation Calculator):[16] Certain products cater to the wealthy, whose conspicuous consumption of luxury goods and services includes, for example: mansions, yachts, first-class airline tickets and private jets, and personal umbrella insurance.

[21] As economic growth has made historically expensive items affordable for the middle-class, purchases have trended towards intangible products such as education.

These clients are often considered to have characteristics similar to institutional investors because the vast majority of their net worth and current income is derived from passive sources rather than labor.

By 2012, according to Reuters, the UHNW individuals held $32 trillion in offshore havens, representing $280 billion in lost income tax revenues.

[3] As of 2014, Asia's growth was expected to continue,[35] and this change in demographics has significant impact on the various organizations that target UHNW individuals, such as luxury companies, financial institutions, charities and universities.

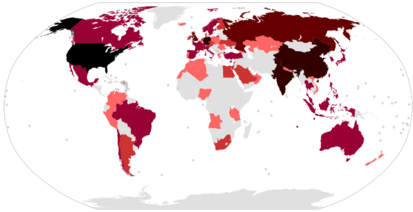

The following is a list of the countries with the most Ultra high-net-worth individuals (UHNWI), as of 2023 as per the 2024 Knight Frank's Wealth Report:[36], which it defines as person having net worth of $30 million or more.

[37] UHNWIs are notable players in the field of philanthropy; many have their own private foundations and support a variety of causes, from education to poverty relief.

Financial institutions are known for their targeting of UHNWIs, having specific parts of their bank designed to manage the wealth of their UHNW clients.

Daily Finance in 2014, projected that growth in Asia's UHNW population looked promising for the future of the luxury industry.

[41] The following table shows the countries with the highest net inflows of HNWIs in 2024 according to the annual Henley & Partners Wealth Migration Report (figures have been rounded to the nearest 100):[42]