Wealth inequality in the United States

[2] Wealth commonly includes the values of any homes, automobiles, personal valuables, businesses, savings, and investments, as well as any associated debts.

Wealth is usually not used for daily expenditures or factored into household budgets, but combined with income, it represents a family's total opportunity to secure stature and a meaningful standard of living, or to pass their class status down to their children.

"[35] According to an analysis of Survey of Consumer Finances data from 2019 by the People's Policy Project, 79% of the country's wealth is owned by millionaires and billionaires.

[40] In the late 18th century, “incomes were more equally distributed in colonial America than in any other place that can be measured,” according to Peter Lindert and Jeffrey Williamson.

Some reasons for this include the ease that the average American had in buying frontier land, which was abundant at the time, and an overall scarcity of labor in non-slaveholding areas, which forced landowners to pay higher wages.

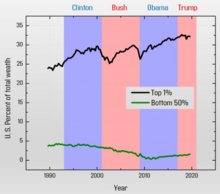

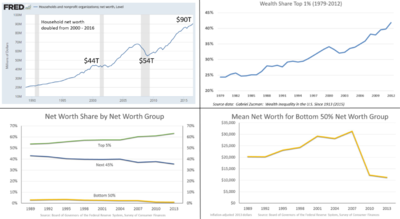

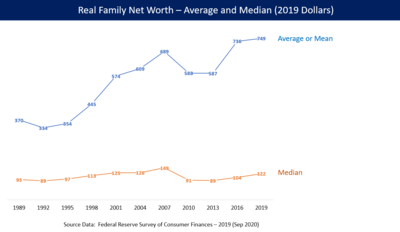

[41] The Federal Reserve publishes information on the distribution of household assets, debt, and equity (net worth) by quarter going back to 1989.

The top 1 percent, by contrast, wasn't just rich — it was specifically rich in terms of owning companies, both stock in publicly traded ones ("corporate equities") and shares of closely held ones ("private businesses")...So the value of those specific assets — assets that people in the bottom half of the distribution never had a chance to own in the first place — soared.

Income refers to a flow of money over time, commonly in the form of a wage or salary; wealth is a collection of assets owned, minus liabilities.

Dividends from trusts or gains in the stock market do not fall under the aforementioned definition of income, but are commonly the primary source of capital for the ultra-wealthy.

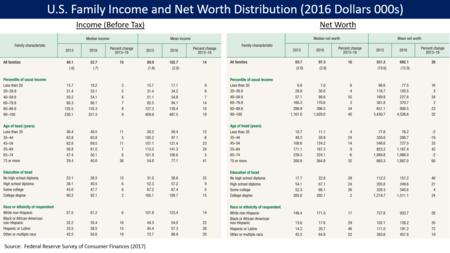

Recent research shows that many households, in particular, those headed by young parents (younger than 35), minorities, and individuals with low educational attainment, display very little accumulation.

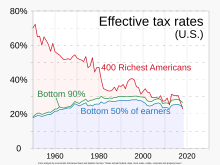

[62][63] A study by Emmanuel Saez and Piketty showed that the top 10 percent of earners earned more than half of the country's total income in 2012, the highest level recorded since the government began collecting the relevant data a century ago.

Further, more than one-third of Americans who work full-time have no access to pensions or retirement accounts such as 401(k)s that derive their value from financial assets like stocks and bonds.

Rather, "after debt payments, poor families are constrained to spend the remaining income on items that will not produce wealth and will depreciate over time.

"[74] Scholar David B. Grusky notes that "62 percent of households headed by single parents are without savings or other financial assets.

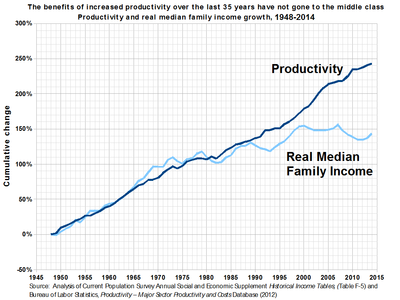

Factors that contribute to this gap in wages are things such as level of education, labor market demand and supply, gender differences, growth in technology, and personal abilities.

The Seven Pillars Institute for Global Finance and Ethics argues that because of this "technological advance", the income gap between workers and owners has widened.

[74] Wealthy parents often use their economic or political power to advantage their own children, such as by providing extra funding for education, excluding poor families from the local community or schools (usually through exclusionary zoning), using social connections to provide opportunities for advancement like internships, and allowing children to take entrepreneurial risks without risking homelessness or destitution.

Affluent people are more likely to allocate their money to financial assets such as stocks, bonds, and other investments which hold the possibility of capital appreciation.

[79] This difference comprises the largest reason for the continuation of wealth inequality in America: the rich are accumulating more assets while the middle and working classes are just getting by.

[80] However, other studies argue that higher average savings rate will contribute to the reduction of the share of wealth owned by the rich.

The study found that the U.S. redistributes a greater share of its wealth to the bottom half of the income distribution than any European country.

The study found instead that Europe had less economic inequality because it had been more successful at ensuring that the bottom half of the income distribution are able to get relatively well-paying jobs.

[87] Inheritance can directly link the disadvantaged economic position and prospects of today's blacks to the disadvantaged positions of their parents' and grandparents' generations, according to a report done by Robert B. Avery and Michael S. Rendall that pointed out "one in three white households will receive a substantial inheritance during their lifetime compared to only one in ten black households.

Using this data as an indicator only several thousand of the over 14 million African American households have more than $1.2 million in net assets ...[91]Relying on data from Credit Suisse and Brandeis University's Institute on Assets and Social Policy, the Harvard Business Review in the article "How America's Wealthiest Black Families Invest Money" stated:[citation needed] If you're white and have a net worth of about $356,000, that's good enough to put you in the 72nd percentile of white families.

"[97][98] When Janet Yellen, the chair of the Federal Reserve was questioned by Senator Bernie Sanders about the study at a congressional hearing in May 2014, she responded "There's no question that we've had a trend toward growing inequality" and that this trend "can shape [and] determine the ability of different groups to participate equally in a democracy and have grave effects on social stability over time.

"[99] In Capital in the Twenty-First Century, French economist Thomas Piketty argues that "extremely high levels" of wealth inequality are "incompatible with the meritocratic values and principles of social justice fundamental to modern democratic societies" and that "the risk of a drift towards oligarchy is real and gives little reason for optimism about where the United States is headed.

[104] A 2021 investigation using leaked IRS documents found more than half of the richest 100 Americans use grantor retained annuity trusts to avoid paying estate taxes when they die.

[110] Economists Emmanuel Saez and Gabriel Zucman analyzed the Warren's proposal and estimated that about 75,000 households (less than 0.1%) would pay the tax.

[112] An analysis by the think tank Tax Foundation found that Warren's proposal would reduce long-term GDP by 0.37% and raise $2.2 trillion over a period of ten years, after factoring in macroeconomic feedback effects.

[113] Senators Charles Schumer and Bernie Sanders advocated limiting stock buybacks to reduce income and wealth inequality in January 2019.