Home Owners' Loan Corporation

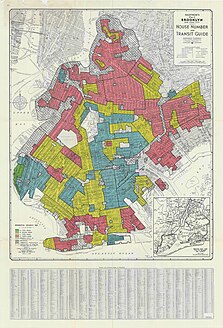

The HOLC created a housing appraisal system of color-coded maps that categorized the riskiness of lending to households in different neighborhoods.

While the maps relied on various housing and economic measures, they also used demographic information (such as the racial, ethnic, and immigrant composition of neighborhoods) to categorize creditworthiness.

It was assigned with other components of abolished FHLBB to the Federal Home Loan Bank Administration (FHLBA), National Housing Agency, by EO 9070, February 24, 1942.

It was terminated by order of Home Loan Bank Board Secretary, effective February 3, 1954, pursuant to an act of June 30, 1953 (67 Stat. 121).

[11][12]HOLC maps[13] generated during the 1930s to assess credit-worthiness were color-coded by mortgage security risk, with majority African-American areas disproportionately likely to be marked in red indicating designation as "hazardous.

[15] Perhaps ironically, HOLC had issued refinancing loans to African American homeowners in its initial "rescue" phase before it started making its redlining maps.

[18] "It's as if some of these places have been trapped in the past, locking neighborhoods into concentrated poverty," said Jason Richardson, director of research at the NCRC, a consumer advocacy group.

[19] A 2020 study in the American Sociological Review found that HOLC led to substantial and persistent increases in racial residential segregation.

[4] A 2021 study in the American Economic Journal found that areas classified as high-risk on HOLC maps became increasingly segregated by race during the next 30–35 years, and suffered long-run declines in home ownership, house values, and credit scores.

[22] According to a paper by economic historian Price V. Fishback and three co-authors, issued in 2021,[23] the blame placed on HOLC is misplaced.

[23]: 10-11 By contrast, it is well documented that private lenders understood which neighborhoods the FHA favored and disfavored; suburban greenfield developers often explicitly advertised the FHA-insurability of their properties in ads for prospective buyers.