Homeownership in the United States

Additionally, homeowner equity has fallen steadily since World War II and is now less than 50% of the value of homes on average.

[6] Homeownership was most common in rural areas and suburbs, with three quarters of suburban households being homeowners.

[2] Recent research has examined the decline in homeownership rates among households with "heads" aged 25 to 44 years.

The rates fell substantially between 1980 and 2000, and recovered only partially during the United States housing bubble of the early 2000s.

This research indicates that a trend toward marrying later and the increase in household earnings risk that occurred after 1980 account for a large share of the decline in young homeownership.

[13][14] In the United States, the home ownership rate is created through the Housing Vacancy Survey by the U.S. Census Bureau.

Homeownership has been promoted as government policy using several means involving mortgage debt and the government sponsored entities Freddie Mac, Fannie Mae, and the Federal Home Loan Banks, which fund or guarantee $6.5 trillion of assets with the purpose of directly or indirectly promoting homeownership.

[16] Although a landmark[17] United States Supreme Court ruling Shelley v. Kraemer 334 U.S. 1 (1948),[a] ruled invalid exclusionary racial covenants, which almost always barred black citizens from owning a home but often extended to American Jews, Asian Americans, Mexican Americans, and non-citizens and other ethnic groups and could be used by white real estate owners to enforce or introduce racial segregation, threats of legal action allowed them to remain effective for some time afterwards.

[18] Racial steering practices later on also affected patterns of home ownership among non-whites[19] and the cumulative effects of exclusionary covenants, racial steering, and other segregation measures have resulted in lower property values, less capital accumulation, lower municipal tax revenues, and disinvestment in black communities.

[20] Despite the fact that the Shelley v. Kraemer decision found exclusionary covenants to be unconstitutional under the Fourteenth Amendment to the United States Constitution's Equal Protection Clause 77 years ago, and hence unenforceable, the clauses are still present in many deeds well into the twenty-first century.

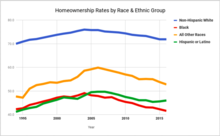

Temporal fluctuations were slight for all races, with rates commonly not changing more than two percentage points per year.

[21] According to the National Association of Realtors, blacks and Hispanic Americans face higher mortgage rates than their white and Asian counterparts, and more illegal discrimination in real estate transactions.

The Fair Housing Act is a law established to help stop illegal discrimination against potential minority homeowners in the U.S.

[24] As of 2006, married couple families, which also have the highest median income of any household type, were most likely to own a home.

Overall married couple families with a householder age 70 to 74 had the highest homeownership rate with 93.3% being homeowners.

[26] According to a 2004 report, among homeowners with household incomes in the top 10%, those earning more than $120,000 a year, home values were considerably higher while houses were larger and newer.

[27] High demand and low supply in most cities will likely continue to keep home prices outpacing income increases.

Becoming a homeowner influences an individual's political outlook, as they are more likely to vote in ways they perceive as protecting their investment.