Income distribution

Important theoretical and policy concerns include the balance between income inequality and economic growth, and their often inverse relationship.

Public Spending: Directing government expenditure towards education, healthcare, and social security to support lower-income groups.

There is not a clear view on how long-run trends in income concentration are shaped by the major changes in woman's labour force participation.

Capital in the Twenty-First Century (2013) by French economist Thomas Piketty is noted for its systematic collection and review of available data, especially concerning income levels; not all aspects of historical wealth distribution are similarly attested in the available records.

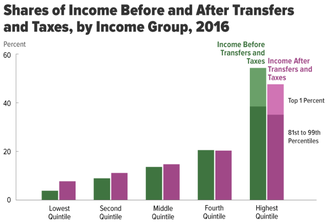

Every person in this system would have access to the same social benefits, but the rich pay more for it, so progressive tax significantly reduces the inequality.

Socioeconomic standing is captured by four different measures:[9] It is known that labor union reduces the income inequality in both private and public sectors, and research conducted by David Card et al. showed that unionization redressed the income inequality in America and Canada, especially in their public sectors.

[10] Using Gini coefficients, several organizations, such as the United Nations (UN) and the US Central Intelligence Agency (CIA), have measured income inequality by country.

[12] Standard economic theory stipulates that inequality tends to increase over time as a country develops, and to decrease as a certain average income is attained.

Various explanations for the remaining 25% to 40% have been suggested, including women's lower willingness and ability to negotiate salary and sexual discrimination.

[17][18] A study by the Brandeis University Institute on Assets and Social Policy which followed the same sets of families for 25 years found that there are vast differences in wealth across racial groups in the United States.

The study concluded that factors contributing to the inequality included years of home ownership (27%), household income (20%), education (5%), and familial financial support and/or inheritance (5%).

[21] Furthermore, increased inter-country income inequality over a long period is conclusive, with the Gini coefficient (using PPP exchange rate, unweighted by population) more than doubling between 1820 and the 1980s from .20 to .52 (Nolan 2009:63).

[22] However, scholars disagree about whether inter-country income inequality has increased (Milanovic 2011),[23] remained relatively stable (Bourguignon and Morrisson 2002),[24] or decreased (Sala-i-Martin, 2002)[25] since 1980.

While the specifics can vary greatly by region and country, the common themes of technological change, globalization, policy choices, and demographic shifts play pivotal roles in shaping the dynamics of income inequality worldwide.

Addressing these issues requires a nuanced understanding of both global trends and local contexts, as well as coordinated efforts across multiple sectors of society.

The government has responded with policies aimed at converting non-regular positions to regular ones, increasing the minimum wage, and enhancing social security for low-income families.

Addressing income inequality in Japan moving forward will require policies that tackle demographic challenges, ensure fair employment practices, and foster inclusive economic growth.

Enhancing the social safety net and providing targeted assistance to vulnerable groups will be key to mitigating income inequality's impacts.

India's economy was growing rapidly in 2011, but a big section of the population was still living in poverty, making income disparity a serious problem.

[32] Thailand has been ranked the world's third most unequal nation after Russia and India, with a widening gap between rich and poor according to Oxfam in 2016.

[46][47] Causes of inequality may include executive compensation increasing relative to the average worker, financialization, greater industry concentration, lower unionization rates, lower effective tax rates on higher incomes, and technology changes that reward higher educational attainment.

[50][51] 2019: The United Kingdom was doing a lot to reduce one of the widest gap between rich and poor citizens, what has led to getting on the 13th place in the ranking of income inequality in the world.

The first democratic elections in 1994 were promising in terms of equal opportunities and living standards for South African population, but a few decades later the inequality is still very high.

One section is built around an advanced capitalist economy while the other one is highly underdeveloped and mostly filled by black South Africans, which further leads to racial division of local population.

In most major emerging economies, income inequality rose over the past three decades (2016), namely in China, Russia, South Africa and India.

In particular, the Bolsa Família program, introduced by reelected president Luiz Inácio Lula da Silva, whose goal is to support families in need.

Although criticized, this program has not only helped reduce income inequality, but also increased literacy and lower child labor and mortality.

In addition, progressive taxation, as well as schooling, demographic changes, and labor market segmentation, contributed to reducing inequality.

[60] In the past, the income distribution in Nordic countries including Denmark, Sweden, Norway, Finland, and Iceland was renowned for being relatively low compared to the rest of the world.

It is difficult to create a realistic and not complicated theoretical model, because the forces determining the distribution of income (DoI) are varied and complex and they continuously interact and fluctuate.

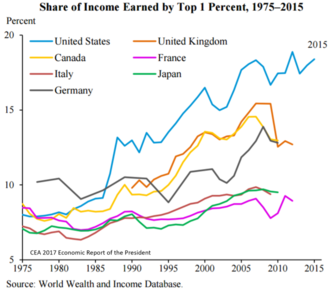

Finally, in 2023 the disproportionate rise of the top earners feel (red line).

-

<30

-

30-35

-

35-40

-

40-45

-

45-50

-

50+