Income tax in India

[2] Income-tax law consists of the 1961 act, Income Tax Rules 1962, Notifications and Circulars issued by the Central Board of Direct Taxes (CBDT), annual Finance Acts, and judicial pronouncements by the Supreme and high courts.

The government taxes certain income of individuals, Hindu Undivided Families (HUF's), companies, firms, LLPs, associations, bodies, local authorities and any other juridical person.

The earliest archaeological evidence of taxation in India is found in Ashoka's pillar inscription at Lumbini.

According to the inscription, tax relief was given to the people of Lumbini (who paid one-eighth of their income, instead of one-sixth).

[6] In the Manusmriti, Manu says that the king has the sovereign power to levy and collect tax according to Shastra:[7] लोके च करादिग्रहणो शास्त्रनिष्ठः स्यात् । — Manu, Sloka 128, Manusmriti[7] ("It is in accordance with Sastra to collect taxes from citizens.

")The Baudhayana sutras note that the king received one-sixth of the income from his subjects, in return for protection.

Kalidasa's Raghuvamsha, eulogizing King Dilipa, says: "it was only for the good of his subjects that he collected taxes from them just as the sun draws moisture from the earth to give it back a thousand time.

To fill the treasury, the first Income-tax Act was introduced in February 1860 by Sir James Wilson (British India's first finance minister).

[9] In 1956, Nicholas Kaldor was appointed to investigate the Indian tax system in light of the Second Five-Year Plan's revenue requirement.

[9] The Direct Taxes Administration Enquiry Committee, under the chairmanship of Mahavir Tyagi, submitted its report on 30 November 1959 and its recommendations took shape in the Income-tax Act, 1961.

Current income-tax law is governed by the 1961 act, which has 298 sections and fourteen schedules.

[11] The New Tax Regime was announced for individuals & HUF in Budget 2020 and became effective from financial year 2020-21.

According to it, individuals can opt for reduced tax rates with no option for claiming exemptions & deductions.

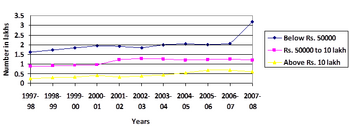

The common man, who fall under the 10- and 20-percent slabs, grew by an average of seven percent annually to 2.78 million income-tax payers.

[17] Although individual and HUF taxpayers must file their income-tax returns online, digital signatures are not required.

For new companies incorporated after 1 October 2019 and beginning production before 31 March 2023, the tax rate is 15 percent.