Security (finance)

In some countries and languages people commonly use the term "security" to refer to any form of financial instrument, even though the underlying legal and regulatory regime may not have such a broad definition.

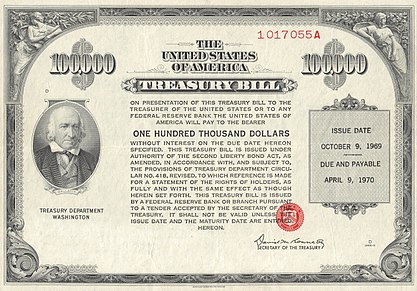

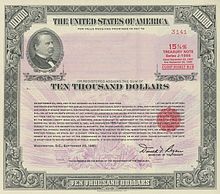

Securities may be represented by a certificate or, more typically, they may be "non-certificated", that is in electronic (dematerialized) or "book entry only" form.

In the United Kingdom, the Financial Conduct Authority functions as the national competent authority for the regulation of financial markets; the definition in its Handbook of the term "security"[1] applies only to equities, debentures, alternative debentures, government and public securities, warrants, certificates representing certain securities, units, stakeholder pension schemes, personal pension schemes, rights to or interests in investments, and anything that may be admitted to the Official List.

Debt securities may be called debentures, bonds, deposits, notes or commercial paper depending on their maturity, collateral and other characteristics.

Commercial paper is a simple form of debt security that essentially represents a post-dated cheque with a maturity of not more than 270 days.

Typically they carry a lower rate of interest than corporate bonds, and serve as a source of finance for governments.

Because of their liquidity and perceived low risk, treasuries are used to manage the money supply in the open market operations of non-US central banks.

Equity also enjoys the right to profits and capital gain, whereas holders of debt securities receive only interest and repayment of principal regardless of how well the issuer performs financially.

However, from a legal perspective, preference shares are capital stocks and therefore may entitle the holders to some degree of control depending on whether they carry voting rights.

In distinction, the greatest part of investment in terms of volume, is wholesale, i.e., by financial institutions acting on their own account, or on behalf of clients.

The traditional economic function of the purchase of securities is investment, with the view to receiving income or achieving capital gain.

Debt holdings may also offer some measure of control to the investor if the company is a fledgling start-up or an old giant undergoing restructuring.

Where A is owed a debt or other obligation by B, A may require B to deliver property rights in securities to A, either at inception (transfer of title) or only in default (non-transfer-of-title institutional).

For institutional loans, property rights are not transferred but nevertheless enable A to satisfy its claims in case B fails to make good on its obligations to A or otherwise becomes insolvent.

Issuers usually retain investment banks to assist them in administering the IPO, obtaining regulatory approval of the offering filing, and selling the new issue.

When the investment bank buys the entire new issue from the issuer at a discount to resell it at a markup, it is called a firm commitment underwriting.

Otherwise, few people would purchase primary issues, and, thus, companies and governments would be restricted in raising equity capital (money) for their operations.

In Europe, the principal trade organization for securities dealers is the International Capital Market Association.

Privately placed securities are not publicly tradable and may only be bought and sold by sophisticated qualified investors.

Growth in informal electronic trading systems has challenged the traditional business of stock exchanges.

Market players include BNY Mellon, J.P. Morgan, HSBC, Citi, BNP Paribas, Société Générale etc.

Securities may also be held in the Direct Registration System (DRS), which is a method of recording shares of stock in book-entry form.

In the United Kingdom, for example, the issue of bearer securities was heavily restricted firstly by the Exchange Control Act 1947 until 1953.

Bearer securities are very rare in the United States because of the negative tax implications they may have to the issuer and holder.

Instead, the issuer (or its appointed agent) maintains a register in which details of the holder of the securities are entered and updated as appropriate.

Modern practice has developed to eliminate both the need for certificates and maintenance of a complete security register by the issuer.

In the United States, the current "official" version of Article 8 of the Uniform Commercial Code permits non-certificated securities.

DTC's parent, Depository Trust & Clearing Corporation (DTCC), is a non-profit cooperative owned by approximately thirty of the largest Wall Street players that typically act as brokers or dealers in securities.

Goldman Sachs in turn may hold millions of Coca-Cola shares on its books on behalf of hundreds of brokers similar to Jones & Co. Each day, the DTC participants settle their accounts with the other DTC participants and adjust the number of shares held on their books for the benefit of customers like Jones & Co.

The issuer owes only one set of obligations to shareholders under its memorandum, articles of association and company law.