Individual mandate

[3] An Act for the relief of sick and disabled seamen, signed into law by President John Adams in 1798, required employers to withhold 20 cents per month from each seaman's pay and turn it over to a Collector of the Federal Treasury when in port, and authorized the President to use the money to pay for "the temporary relief and maintenance of sick or disabled seamen," and to build hospitals to accommodate sick and disabled seamen.

[6][7] However, as it was similar to workers' compensation, Social Security Disability Insurance, and Medicare, there exists some debate as to whether it can be properly called an individual mandate, because it did not require anyone to purchase anything themselves.

Individuals are exempt from penalty if there is no insurance plan available at a price that satisfies an affordability formula (based on income) defined by the Massachusetts Health Connector Board.

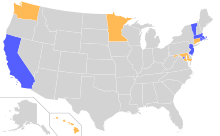

In the United States, the Affordable Care Act (ACA) signed in 2010 by President Barack Obama imposed a health insurance mandate which took effect in 2014.

[10] The penalty for not having insurance that meets the minimum coverage requirements, either from an employer or by individual purchase is enforced in the calculation of personal income tax.

[19][20] In Australia, all states and territories now have legislation that requires home and building owners to install smoke alarms.