Isoelastic utility

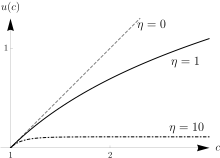

The isoelastic utility function is a special case of hyperbolic absolute risk aversion and at the same time is the only class of utility functions with constant relative risk aversion, which is why it is also called the CRRA (constant relative risk aversion) utility function.

is a constant that is positive for risk averse agents.

[1] Since additive constant terms in objective functions do not affect optimal decisions, the –1 is sometimes omitted in the numerator (although it should be kept if one wishes to preserve mathematical consistency with the limiting case of

The isoelastic utility function is a special case of the hyperbolic absolute risk aversion (HARA) utility functions, and is used in analyses that either include or do not include underlying risk.

There is substantial debate in the economics and finance literature with respect to the true value of

to be 1.5 in the United Kingdom,[4] while Evans (2005) estimated its value to be around 1.4 in 20 OECD countries.

[5] The utility of income can also be estimated using subjective well-being surveys.

Using six national and international such surveys, Layard et al. (2008) found values between 1.19 an 1.34 with a combined estimate of 1.19.

[6] This utility function has the feature of constant relative risk aversion.

In theoretical models this often has the implication that decision-making is unaffected by scale.

For instance, in the standard model of one risk-free asset and one risky asset, under constant relative risk aversion the fraction of wealth optimally placed in the risky asset is independent of the level of initial wealth.