Itô's lemma

It can be heuristically derived by forming the Taylor series expansion of the function up to its second derivatives and retaining terms up to first order in the time increment and second order in the Wiener process increment.

The lemma is widely employed in mathematical finance, and its best known application is in the derivation of the Black–Scholes equation for option values.

is simply the integral of the variance of each infinitesimal step in the random walk:

However, sometimes we are faced with a stochastic differential equation for a more complex process

In practice, Ito's lemma is used in order to find this transformation.

We derive Itô's lemma by expanding a Taylor series and applying the rules of stochastic calculus.

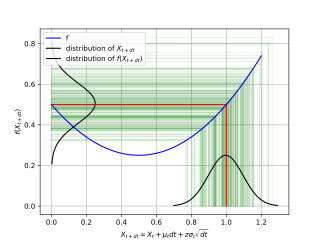

is convex, then the deterministic contribution is positive (by Jensen's inequality).

To understand why there should be a contribution due to convexity, consider the simplest case of geometric Brownian walk (of the stock market):

In the following subsections we discuss versions of Itô's lemma for different types of stochastic processes.

h could be a constant, a deterministic function of time, or a stochastic process.

The change in the survival probability is So Let S(t) be a discontinuous stochastic process.

contains drift, diffusion and jump parts, then Itô's Lemma for

Itô's lemma can also be applied to general d-dimensional semimartingales, which need not be continuous.

In general, a semimartingale is a càdlàg process, and an additional term needs to be added to the formula to ensure that the jumps of the process are correctly given by Itô's lemma.

Then, Itô's lemma states that if X = (X1, X2, ..., Xd) is a d-dimensional semimartingale and f is a twice continuously differentiable real valued function on Rd then f(X) is a semimartingale, and This differs from the formula for continuous semi-martingales by the additional term summing over the jumps of X, which ensures that the jump of the right hand side at time t is Δf(Xt).

[citation needed]There is also a version of this for a twice-continuously differentiable in space once in time function f evaluated at (potentially different) non-continuous semi-martingales which may be written as follows: where

A process S is said to follow a geometric Brownian motion with constant volatility σ and constant drift μ if it satisfies the stochastic differential equation

gives It follows that exponentiating gives the expression for S, The correction term of − σ2/2 corresponds to the difference between the median and mean of the log-normal distribution, or equivalently for this distribution, the geometric mean and arithmetic mean, with the median (geometric mean) being lower.

See geometric moments of the log-normal distribution[broken anchor] for further discussion.

The same factor of σ2/2 appears in the d1 and d2 auxiliary variables of the Black–Scholes formula, and can be interpreted as a consequence of Itô's lemma.

[2] Suppose a stock price follows a geometric Brownian motion given by the stochastic differential equation dS = S(σdB + μ dt).

Then, if the value of an option at time t is f(t, St), Itô's lemma gives The term ∂f/∂S dS represents the change in value in time dt of the trading strategy consisting of holding an amount ∂ f/∂S of the stock.

If this trading strategy is followed, and any cash held is assumed to grow at the risk free rate r, then the total value V of this portfolio satisfies the SDE This strategy replicates the option if V = f(t,S).

Substituting these values in the multi-dimensional version of the lemma gives us: This is a generalisation of Leibniz's product rule to Ito processes, which are non-differentiable.

Hans Föllmer provided a non-probabilistic proof of the Itô formula and showed that it holds for all functions with finite quadratic variation.

a right-continuous function with left limits and finite quadratic variation

Then where the quadratic variation of $x$ is defined as a limit along a sequence of partitions

Rama Cont and Nicholas Perkowski extended the Ito formula to functions with finite p-th variation:.

where the first integral is defined as a limit of compensated left Riemann sums along a sequence of partitions

There exist a couple of extensions to infinite-dimensional spaces (e.g. Pardoux,[5] Gyöngy-Krylov,[6] Brzezniak-van Neerven-Veraar-Weis[7]).

![{\displaystyle E[f(X_{t+dt})]}](https://wikimedia.org/api/rest_v1/media/math/render/svg/3847d540a61535c2453b66574c61361389ac302d)

![{\displaystyle f(E[X_{t+dt}])}](https://wikimedia.org/api/rest_v1/media/math/render/svg/0fa1226c75ef2dbab8e442fca344fd4cf0502026)

![{\displaystyle f''(E[X_{t+dt}])}](https://wikimedia.org/api/rest_v1/media/math/render/svg/6d9dddbaa488acef1bf96b7fe890905d6beb5f92)