Kelly criterion

[1] The practical use of the formula has been demonstrated for gambling,[2][3] and the same idea was used to explain diversification in investment management.

[4] In the 2000s, Kelly-style analysis became a part of mainstream investment theory[5] and the claim has been made that well-known successful investors including Warren Buffett[6] and Bill Gross[7] use Kelly methods.

), the formula gives a negative result, indicating that the gambler should take the other side of the bet.

This happens somewhat counterintuitively, because the Kelly fraction formula compensates for a small losing size with a larger bet.

In the case of a Kelly fraction higher than 1, it is theoretically advantageous to use leverage to purchase additional securities on margin.

In a study, each participant was given $25 and asked to place even-money bets on a coin that would land heads 60% of the time.

But the behavior of the test subjects was far from optimal: Remarkably, 28% of the participants went bust, and the average payout was just $91.

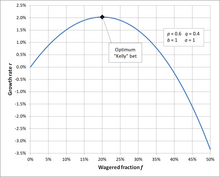

[10][11]Using the Kelly criterion and based on the odds in the experiment (ignoring the cap of $250 and the finite duration of the test), the right approach would be to bet 20% of one's bankroll on each toss of the coin, which works out to a 2.034% average gain each round.

gives the Kelly criterion: Notice that this expression reduces to the simple gambling formula when

For example, the cases below take as given the expected return and covariance structure of assets, but these parameters are at best estimates or models that have significant uncertainty.

A detailed paper by Edward O. Thorp and a co-author estimates Kelly fraction to be 117% for the American stock market SP500 index.

A rigorous and general proof can be found in Kelly's original paper[1] or in some of the other references listed below.

and get: The function is maximized when this derivative is equal to zero, which occurs at: which implies that but the proportion of winning bets will eventually converge to: according to the weak law of large numbers.

leads to the desired result Edward O. Thorp provided a more detailed discussion of this formula for the general case.

each time will likely maximize the wealth growth rate only in the case where the number of trials is very large, and

Kelly's criterion may be generalized[16] on gambling on many mutually exclusive outcomes, such as in horse races.

Kelly's criterion for gambling with multiple mutually exclusive outcomes gives an algorithm for finding the optimal set

of outcomes on which it is reasonable to bet and it gives explicit formula for finding the optimal fractions

-th outcome may be calculated from this formula: One may prove[16] that where the right hand-side is the reserve rate[clarification needed].

-th horse winning over the reserve rate divided by revenue after deduction of the track take when

The binary growth exponent is and the doubling time is This method of selection of optimal bets may be applied also when probabilities

This approximation may offer similar results as the original criterion,[17] but in some cases the solution obtained may be infeasible.

), and a risk-free rate, it is easy to obtain the optimal fraction to invest through geometric Brownian motion.

Confusing this is a common mistake made by websites and articles talking about the Kelly Criterion.

There is also a numerical algorithm for the fractional Kelly strategies and for the optimal solution under no leverage and no short selling constraints.

[19] In a 1738 article, Daniel Bernoulli suggested that, when one has a choice of bets or investments, one should choose that with the highest geometric mean of outcomes.

This is mathematically equivalent to the Kelly criterion, although the motivation is different (Bernoulli wanted to resolve the St. Petersburg paradox).

[21] In colloquial terms, the Kelly criterion requires accurate probability values, which isn't always possible for real-world event outcomes.

When a gambler overestimates their true probability of winning, the criterion value calculated will diverge from the optimal, increasing the risk of ruin.

There is also a difference between ensemble-averaging (utility calculation) and time-averaging (Kelly multi-period betting over a single time path in real life).