Kondratiev wave

[7] Two Dutch economists, Jacob van Gelderen and Salomon de Wolff, had previously argued for the existence of 50- to 60-year cycles in 1913 and 1924, respectively.

The Marxist scholar Ernest Mandel revived interest in long-wave theory with his 1964 essay predicting the end of the long boom after five years and in his Alfred Marshall lectures in 1979.

However, in Mandel's theory long waves are the result of the normal business cycle and noneconomic factors, such as wars.

[8] In 1996, George Modelski and William R. Thompson published a book documenting K-Waves dating back to 930 AD in China.

Writing in the 1920s, Kondratiev proposed to apply the theory to the 19th century: The long cycle supposedly affects all sectors of an economy.

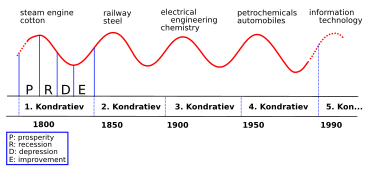

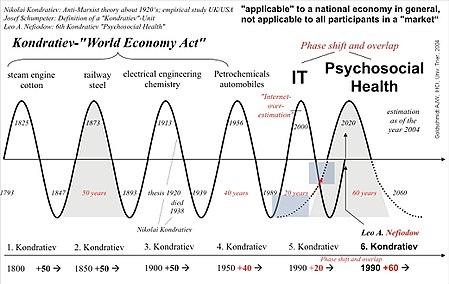

The theory hypothesized the existence of very long-run macroeconomic and price cycles, originally estimated to last 50–54 years.

Some of the works involving long cycle research and technology include Mensch (1979), Tylecote (1991), the International Institute for Applied Systems Analysis (IIASA) (Marchetti, Ayres), Freeman and Louçã (2001), Andrey Korotayev[13] and Carlota Perez.

Perez (2002) places the phases on a logistic or S curve, with the following labels: the beginning of a technological era as irruption, the ascent as frenzy, the rapid build out as synergy and the completion as maturity.

Land is a finite resource which is necessary for all production and they claim that because exclusive usage rights are traded around, this creates speculative bubbles which can be exacerbated by overzealous borrowing and lending.

That allowed new land to the west to be purchased and after four or five years to be cleared and be in production, driving down prices and causing a depression as in 1819 and 1839.

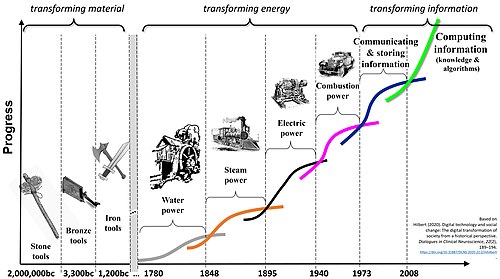

The custom of classifying periods of human development by its dominating general purpose technology has surely been borrowed from historians, starting with the Stone Age.

It started out with the proliferation of communication and stored data and has now entered the age of algorithms, which aims at creating automated processes to convert the existing information into actionable knowledge.

[22] Several papers on the relationship between technology and the economy were written by researchers at the International Institute for Applied Systems Analysis (IIASA).

A concise version of Kondratiev cycles can be found in the work of Robert Ayres (1989) in which he gives a historical overview of the relationships of the most significant technologies.

[27] Korotayev et al. recently employed spectral analysis and claimed that it confirmed the presence of Kondratiev waves in the world GDP dynamics at an acceptable level of statistical significance.

Some authors have started to predict what the sixth wave might be, such as James Bradfield Moody and Bianca Nogrady who forecast that it will be driven by resource efficiency and clean technology.

He argued that historical growth phases in combination with key technologies do not necessarily imply the existence of regular cycles in general.

Goldschmidt is of the opinion that different fundamental innovations and their economic stimuli do not exclude each other as they mostly vary in length and their benefit is not applicable to all participants in a market.