Latin American debt crisis

In the 1960s and 1970s, many Latin American countries, notably Brazil, Argentina, and Mexico, borrowed huge sums of money from international creditors for industrialization, especially infrastructure programs.

Petroleum-exporting countries, flush with cash after the oil price increases of 1973–1980, invested their money with international banks, which "recycled" a major portion of the capital as syndicated loans to Latin American governments.

[7] Deterioration in the exchange rate with the US dollar meant that Latin American governments ended up owing tremendous quantities of their national currencies, as well as losing purchasing power.

The banks had to somehow restructure the debts to avoid financial panic; this usually involved new loans with very strict conditions, as well as the requirement that the debtor countries accept the intervention of the International Monetary Fund (IMF).

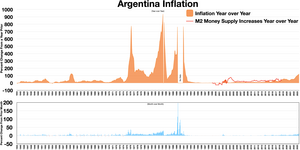

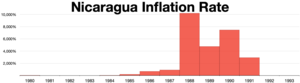

Incomes and imports dropped; economic growth stagnated; unemployment rose to high levels; and inflation reduced the buying power of the middle classes.

[3] Losses to bankers in the United States were catastrophic, perhaps more than the banking industry's entire collective profits since the nation's founding in the late 1700s.

[16]: 136 Before the crisis, Latin American countries such as Brazil and Mexico borrowed money to enhance economic stability and reduce the poverty rate.

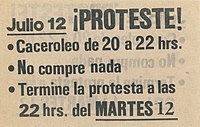

Frantically trying to solve these problems, debtor countries felt constant pressure to repay their debts, increasing the difficulty of rebuilding ruined economies.

In return, the IMF forced Latin America to make reforms that would favor free-market capitalism, further aggravating inequalities and poverty conditions.

[19][failed verification] The IMF also forced Latin America to implement austerity plans and programs that lowered total spending in an effort to recover from the debt crisis.

[22] The application of structural adjustment programs entailed high social costs in terms of rising unemployment and underemployment, falling real wages and incomes, and increased poverty.