Microeconomics

One goal of microeconomics is to analyze the market mechanisms that establish relative prices among goods and services and allocate limited resources among alternative uses.

[6] Particularly in the wake of the Lucas critique, much of modern macroeconomic theories has been built upon microfoundations—i.e., based upon basic assumptions about micro-level behavior.

Although microeconomic theory can continue without this assumption, it would make comparative statics impossible since there is no guarantee that the resulting utility function would be differentiable.

In fact, much analysis is devoted to cases where market failures lead to resource allocation that is suboptimal and creates deadweight loss.

In such cases, economists may attempt to find policies that avoid waste, either directly by government control, indirectly by regulation that induces market participants to act in a manner consistent with optimal welfare, or by creating "missing markets" to enable efficient trading where none had previously existed.

Market failure in positive economics (microeconomics) is limited in implications without mixing the belief of the economist and their theory.

Firms decide which goods and services to produce considering low costs involving labor, materials and capital as well as potential profit margins.

The difference between microeconomics and macroeconomics likely was introduced in 1933 by the Norwegian economist Ragnar Frisch, the co-recipient of the first Nobel Memorial Prize in Economic Sciences in 1969.

The cost-of-production theory of value states that the price of an object or condition is determined by the sum of the cost of the resources that went into making it.

The cost function can be used to characterize production through the duality theory in economics, developed mainly by Ronald Shephard (1953, 1970) and other scholars (Sickles & Zelenyuk, 2019, ch.

Thus many projects are written off leading to losses of millions of dollars [18] Opportunity cost is closely related to the idea of time constraints.

[11] Price theory is a field of economics that uses the supply and demand framework to explain and predict human behavior.

Strategic behavior, such as the interactions among sellers in a market where they are few, is a significant part of microeconomics but is not emphasized in price theory.

Price theorists focus on competition believing it to be a reasonable description of most markets that leaves room to study additional aspects of tastes and technology.

Price theorists have influenced several other fields including developing public choice theory and law and economics.

Price theory has been applied to issues previously thought of as outside the purview of economics such as criminal justice, marriage, and addiction.

Prices and quantities have been described as the most directly observable attributes of goods produced and exchanged in a market economy.

In microeconomics, it applies to price and output determination for a market with perfect competition, which includes the condition of no buyers or sellers large enough to have price-setting power.

Demand theory describes individual consumers as rationally choosing the most preferred quantity of each good, given income, prices, tastes, etc.

Here, utility refers to the hypothesized relation of each individual consumer for ranking different commodity bundles as more or less preferred.

[21] On the supply side of the market, some factors of production are described as (relatively) variable in the short run, which affects the cost of changing output levels.

Their usage rates can be changed easily, such as electrical power, raw-material inputs, and over-time and temp work.

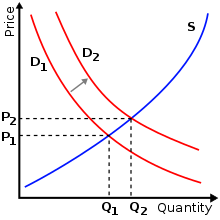

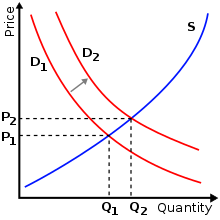

[23] Tracing the qualitative and quantitative effects of variables that change supply and demand, whether in the short or long run, is a standard exercise in applied economics.

Perfect competition is a situation in which numerous small firms producing identical products compete against each other in a given industry.

Perfect competition leads to firms producing the socially optimal output level at the minimum possible cost per unit.

Firms such as Pepsi and Coke and Sony, Nintendo and Microsoft dominate the cola and video game industry respectively.

Because monopolies have no competition, they tend to sell goods and services at a higher price and produce below the socially optimal output level.

Oligopolies can create the incentive for firms to engage in collusion and form cartels that reduce competition leading to higher prices for consumers and less overall market output.

Game theory is a major method used in mathematical economics and business for modeling competing behaviors of interacting agents.

[35] The economics of information has recently become of great interest to many - possibly due to the rise of information-based companies inside the technology industry.