Open market operation

In that situation central banks no longer need to fine tune the supply of reserves to meet demand, implying that they may conduct OMOs less frequently.

[2] In the post-crisis economy, conventional short-term open market operations have been superseded by major central banks by quantitative easing (QE) programmes.

This does not require the creation of new physical currency, unless a direct payment bank demands to exchange a part of its electronic money against banknotes or coins.

In most developed countries, central banks are not allowed to give loans without requiring suitable assets as collateral.

This selling of securities affects the overall economy by decreasing demand for products, services, and workers (because there is less money in circulation that is available for spending), while increasing interest rates and decreasing inflation (because money that is scarcer is more valuable and hard to get which causes people to offer more for it and also demand more for it).

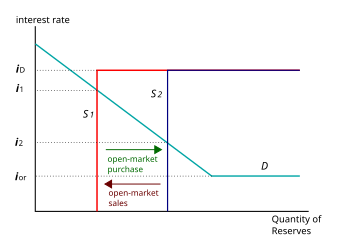

Classical economic theory postulates a distinctive relationship between the supply of central bank money and short-term interest rates: central bank money is like any other commodity in that a higher demand tends to increase its price (the interest rate).

When there is an increased demand for base money, the central bank must act if it wishes to maintain the short-term interest rate.

It does this by increasing the supply of base money: it goes to the open market to buy a financial asset, such as government bonds.

Conversely, if the central bank sells these assets in the open market, the base money is reduced.

Understandably, governments would like to utilize this capacity to meet other political ends like unemployment rate targeting, or relative size of various public services (military, education, health etc.

However, they still form part of the over-all monetary policy toolbox, as they are used to always maintain an ample supply of reserves.

The European Central Bank has similar mechanisms for their operations; it describes its methods as a four-tiered approach with different goals: beside its main goal of steering and smoothing Eurozone interest rates while managing the liquidity situation in the market the ECB also has the aim of signalling the stance of monetary policy with its operations.

In this case the ECB specifies the rate but not the amount of credit made available, and banks can request as much as they wish (subject as always to being able to provide sufficient collateral).

The primary way the SNB influences the three-month Swiss franc LIBOR rate is through open market operations, with the most important monetary policy instrument being repo transactions.

It commenced in June, 2000, and it was set up to oversee liquidity on a daily basis and to monitor market interest rates.