Paper money

In some cases, paper money may be issued by other entities than governments or banks, for example merchants in pre-modern China and Japan.

Fighting the counterfeiting of notes (and, for banks of cheques) has been a principal driver of security printing methods development in recent centuries.

Code of Hammurabi Law 100 (c. 1755–1750 BC) stipulated repayment of a loan by a debtor to a creditor on a schedule with a maturity date specified in written contractual terms.

[18] The French Revolution resulted in the mass issuance of government notes known as assignats whose value soon collapsed, leading Napoleon to establish the Bank of France to issue paper banknotes in the early 1800s.

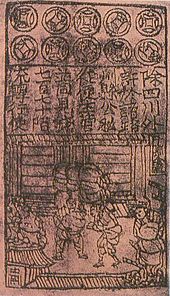

Merchants would issue what are today called promissory notes in the form of receipts of deposit to wholesalers to avoid using the heavy bulk of copper coinage in large commercial transactions.

True paper money, called "jiaozi", developed from these promissory notes by the 11th century, during the Song dynasty.

It was recorded that each year before 1101, the prefecture of Xin'an (modern Shexian, Anhui) alone would send 1,500,000 sheets of paper in seven different varieties to the capital at Kaifeng.

[22] In 1101, the Emperor Huizong of Song decided to lessen the amount of paper taken in the tribute quota because it was causing detrimental effects and creating heavy burdens on the people of the region.

[17] Between 1265 and 1274, the late southern Song government introduced a gold- or silver-backed national paper currency standard, which changed the geographic restriction.

[25][26] In the 13th century, Chinese paper money of Mongol Yuan became known in Europe through the accounts of travelers, such as Marco Polo and William of Rubruck.

[29] All these pieces of paper are, issued with as much solemnity and authority as if they were of pure gold or silver... with these pieces of paper, made as I have described, Kublai Khan causes all payments on his own account to be made; and he makes them to pass current universally over all his kingdoms and provinces and territories, and whithersoever his power and sovereignty extends... and indeed everybody takes them readily, for wheresoever a person may go throughout the Great Kaan's dominions he shall find these pieces of paper current, and shall be able to transact all sales and purchases of goods by means of them just as well as if they were coins of pure goldIn medieval Italy and Flanders, because of the insecurity and impracticality of transporting large sums of cash over long distances, money traders started using promissory notes.

For international payments, the more efficient and sophisticated bill of exchange ("lettera di cambio"), that is, a promissory note based on a virtual currency account (usually a coin no longer physically existing), was used more often.

The shift toward the use of these receipts as a means of payment took place in the mid-17th century, as the price revolution, when relatively rapid gold inflation was causing a re-assessment of how money worked.

The goldsmith bankers of London began to give out the receipts as payable to the bearer of the document rather than the original depositor.

This was a natural extension of debt-based issuance of split tally sticks used for centuries in places like St. Giles Fair,[33] however, done in this way, it was able to directly expand the expansion of the supply of circulating money.

A gold coin's value is simply a reflection of the supply and demand mechanism of a society exchanging goods in a free market, as opposed to stemming from any intrinsic property of the metal.

The economist Nicholas Barbon wrote that money "was an imaginary value made by a law for the convenience of exchange".

[37] A temporary experiment of banknote issue was carried out by Sir William Phips as the governor of the Province of Massachusetts Bay starting on December 20, 1690,[38] to help fund the war effort against France.

[39] The other Thirteen Colonies followed in Massachusetts' wake and began issuing bills of credit, an early form of paper currency distinct from banknotes, to fund military expenditures and for use as a common medium of exchange.

[43] The Scottish economist John Law helped establish banknotes as a formal currency in France, after the wars waged by Louis XIV left the country with a shortage of precious metals for coinage.

At the same time, the Bank of England was restricted to issue new banknotes only if they were 100% backed by gold or up to £14 million in government debt.

[47][48] Prior to the introduction of paper money, precious or semiprecious metals minted into coins to certify their substance were widely used as a medium of exchange.

They now make up a very small proportion of the "money" that people think that they have, as demand deposit bank accounts and electronic payments have negated much of the need to carry notes and coins.

[citation needed] For years, the mode of collecting paper money was through a handful of mail order dealers who issued price lists and catalogs.

The illustrated catalogs and "event nature" of the auction practice seemed to fuel a sharp rise in overall awareness of paper money in the numismatic community.

Entire advanced collections are often sold at one time, and to this day, single auctions can generate millions in gross sales.

Overlapping note images and/or changing the dimensions of the reproduction to be at least 50% smaller or 50% larger than the original are some ways to avoid the risk of being considered a counterfeit.

However, once the decal has been affixed to the resin stack shell and cannot be peeled off, the final product is no longer at risk of being classified as counterfeit, even though the resulting appearance is realistic.