Price of oil

[15] On 18 January 2022, as the price of Brent crude oil reached its highest since 2014—$88, concerns were raised about the rising cost of gasoline—which hit a record high in the United Kingdom.

[20] According to the International Energy Agency, high oil prices generally have a large negative impact on global economic growth.

[20] In 1974, in response to the previous year's oil crisis, the RAND Corporation presented a new economic model of the global oil market that included four sectors—"crude production, transportation, refining, and consumption of products"—analyzed separately for six regions: the United States, Canada, Latin America, Europe, the Middle East and Africa, and Asia.

[28] A 2016 article in the Oxford Institute for Energy Studies describes how analysts offered differing views on why[29] the price of oil had decreased 55% from "June 2014 to January 2015"[30]: 10 following "four years of relative stability at around US$105 per barrel".

[46]: 599 Yergin states that the role of Organization of the Petroleum Exporting Countries (OPEC)—which had been established in 1960, by Iran, Iraq, Kuwait, Saudi Arabia and Venezuela[47][46]: 499 [48][49]— in controlling the price of oil, was dramatically changed.

The "magnitude" of the increase in the price of oil following OPEC's 1973 embargo in reaction to the Yom Kippur War and the 1979 Iranian Revolution, was without precedent.

[63][64] On 31 January 2011, the Brent price hit $100 a barrel briefly for the first time since October 2008, on concerns that the 2011 Egyptian protests would "lead to the closure of the Suez Canal and disrupt oil supplies".

[80] By 3 February 2016 oil was below $30—[81] a drop of "almost 75% since mid-2014 as competing producers pumped 1–2 million barrels of crude daily exceeding demand, just as China's economy hit lowest growth in a generation.

[87] In late September and early October 2018, the price of oil rose to a four-year high of over $80 for the benchmark Brent crude[87] in response to concerns about constraints on global supply.

Saudi Arabia, Iran, and Iraq had the lowest production costs in 2016, while the United Kingdom, Brazil, Nigeria, Venezuela, and Canada had the highest.

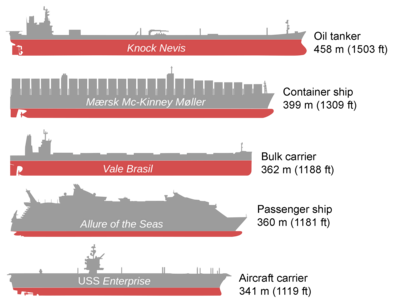

[106][107] In April, as the demand decreased, concerns about inadequate storage capacity resulted in oil firms "renting tankers to store the surplus supply".

[105] An October Bloomberg report on slumping oil prices—citing the EIA among others—said that, with the increasing number of virus cases, the demand for gasoline—particularly in the United States—was "particularly worrisome", while global inventories remained "quite high".

[111] In the fall of 2020, against the backdrop of the resurgent pandemic, the U.S. Energy Information Administration (EIA) reported that global oil inventories remained "quite high" while demand for gasoline—particularly in the United States—was "particularly worrisome.

The price of crude was on the rise since June 2021, after a statement by a top US diplomat that even with a nuclear deal with Iran, hundreds of economic sanctions would remain in place.

[119] Since September 2021, Europe's energy crisis has been worsening, driven by high crude prices and a scarcity of Russian gas on the continent.

[123] In an effort to lower energy prices and to curb inflation, President Biden announced on March 31, 2022, that he would be releasing a million bbl/d from the Strategic Petroleum Reserve (SPR).

[124][125] Bloomberg described how the price of oil, gas and other commodities had risen driven by a global "resurgence in demand" as COVID-19 restrictions were eased, combined with supply chains problems, and "geopolitical tensions".

[127] In May 2024, Chuck Schumer, along with 22 other Democratrs, urged the Department of Justice to take robust action against alleged collusion and price-fixing in the oil industry.

In a letter to Merrick Garland, the senators referenced a FTC investigation revealing price-fixing by oil executives, which had increased energy costs for Americans.

The senators called for a comprehensive DOJ investigation into potential Sherman Antitrust Act violations, citing concerns over national security and economic burdens on lower-income families due to inflated fuel costs.

[128] On 10 October 2024, oil prices surged over 3% due to escalating tensions in the Middle East, raising concerns about potential disruptions to crude supplies.

Fears of retaliatory strikes on oil facilities and possible U.S. involvement grew, while OPEC+ ministers met without expected changes to production policies.

Or they can leave the contract in place and physical oil is "delivered on the set date" to an "officially designated delivery point", in the United States, that is usually Cushing, Oklahoma.

Trafigura, Vitol, Gunvor, Koch, Shell and other major energy companies began to book oil storage supertankers for up to 12 months.

Crude oil storage space became a tradable commodity with CME Group— which owns NYMEX— offering oil-storage futures contracts in March 2015.

The decline in China's demand for commodities also adversely affected the growth of exports and GDP of large commodity-exporting economies such as Australia (minerals) and the Russian Federation (fuel).

[170] Liz Ann Sonders, Chief Investment Strategist at Charles Schwab, had earlier written that that positive impact on consumers and businesses outside of the energy sector, which is a larger portion of the US economy will outweigh the negatives.

[68][69][70] In June 2008 Business Week reported that the surge in oil prices prior to the financial crisis of 2008 had led some commentators to argue that at least some of the rise was due to speculation in the futures markets.

"[84] According to John England, the Vice-chairman Deloitte LLP, "Access to capital markets, bankers' support and derivatives protection, which helped smooth an otherwise rocky road, are fast waning...The roughly 175 companies at risk of bankruptcy have more than $150 billion in debt, with the slipping value of secondary stock offerings and asset sales further hindering their ability to generate cash.

[85] While investors were aware that there was a risk that the operator might declare bankruptcy, they felt protected because "they had come in at the 'bank' level, where there was a senior claim on the assets [and] they could get their capital returned.