Ragnar Nurkse's balanced growth theory

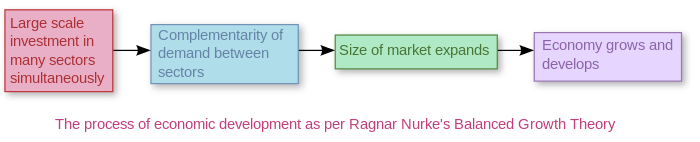

The theory hypothesises that the government of any underdeveloped country needs to make large investments in a number of industries simultaneously.

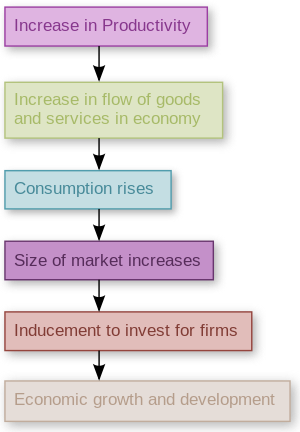

[1][2] This will enlarge the market size, increase productivity, and provide an incentive for the private sector to invest.

[3] He recognised that the expansion and inter-sectoral balance between agriculture and manufacturing is necessary so that each of these sectors provides a market for the products of the other and in turn, supplies the necessary raw materials for the development and growth of the other.

Nurkse and Paul Rosenstein-Rodan were the pioneers of balanced growth theory and much of how it is understood today dates back to their work.

Apart from this, Nurkse has been nicknamed an export pessimist, as he feels that the finances to make investments in underdeveloped countries must arise from their own domestic territory.

[9] The original idea behind this was put forward by Adam Smith, who stated that division of labour (as against inducement to invest) is limited by the extent of the market.

[7] More specifically, due to high transport costs between nations, producers do not have an incentive to export their commodities.

(See Import substitution industrialization) Often, it is true that a company's private endeavour to increase the demand for its products succeeds due to the extensive use of advertisement and other sales promotion technique.

So while a large proportion of the population (70–80%) may be actively employed in the agriculture sector, the contribution to the Gross Domestic Product may be as low as 40%.

This can be done if the government provides irrigation facilities, high-yielding variety seeds, pesticides, fertilisers, tractors etc.

In fact, if such a strategy of financing development from outside the home country is undertaken, it creates a number of problems.

People would try to imitate Western consumption habits and thus a balance of payments crisis may develop, along with economic inequality within the population.

[1] Thus, for a large-scale development to be feasible, the requisite capital must be generated from within the country itself, and not through export surplus or foreign investment.

[8] After World War II, a debate about whether a country should introduce financial planning to develop itself or rely on private entrepreneurs emerged.

[7] The crucial idea was that a large amount of well dispersed investment should be made in the economy, so that the market size expands and leads to higher productivity levels, increasing returns to scale and eventually the development of the country in question.

[7] However, most economists who favoured the balanced growth hypothesis believed that only the state has the capacity to take on the kind of heavy investments the theory propagates.

Further, the gestation period of such lumpy investments is usually long and private sector entrepreneurs do not normally undertake such high risks.

[7] Thus, to hypothesise that an underdeveloped nation can undertake large scale investment in many industries of its economy simultaneously is unrealistic due to the paucity of resources.

[12] To quote Hirschman, "If a country were ready to apply the doctrine of balanced growth, then it would not be underdeveloped in the first place.

"[12]Hans Singer asserted that the balanced growth theory is more applicable to cure an economy facing a cyclical downswing.

[7] Cyclical downswing is a feature of an advanced stage of sustained growth rather than of the vicious cycle of poverty.

Hirschman also stated that during conditions of slack activity in developed countries, the stock of resources, machines and entrepreneurs are merely unemployed, and are present as idle capacity.

The various economic agents are temporarily unemployed and once the inducement to invest starts operating, the slump will be overcome.

However, Keynes stated that Say's law is not operational in any country because people do not spend their entire income – a fraction of it is saved for future consumption.

[11] Thus, according to Nurkse's critics, his assumption of Say's law being operational in underdeveloped countries needs greater justification.

Thus if the state pumps in large investments into the car industry, for example, it will naturally lead to a rise in the demand for petrol.

Hans Singer suggested that Nurkse's theory makes dubious assumptions about the underdeveloped economy.

[5] However, an economy usually starts at a position which reflects the previous investment decisions undertaken in the country,[7] and at any given moment, an imbalance already exists.

[12] In reality, a dual economy will come into existence, where two separate economic sectors will begin to coexist in one country.