Business cycle

The changes in economic activity that characterize business cycles have important implications for the welfare of the general population, government institutions, and private sector firms.

There are many sources of business cycle movements such as rapid and significant changes in the price of oil or variation in consumer sentiment that affects overall spending in the macroeconomy and thus investment and firms' profits.

[2] Prior to that point classical economics had either denied the existence of business cycles,[3] blamed them on external factors, notably war,[4] or only studied the long term.

As well-formed and compact – and easy to implement – statistical methods may outperform macroeconomic approaches in numerous cases, they provide a solid alternative even for rather complex economic theory.

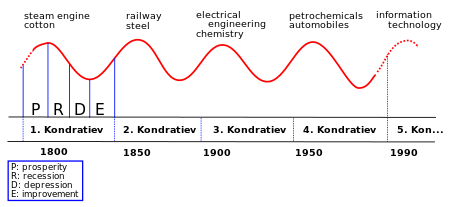

[6] In 1860 French economist Clément Juglar first identified economic cycles 7 to 11 years long, although he cautiously did not claim any rigid regularity.

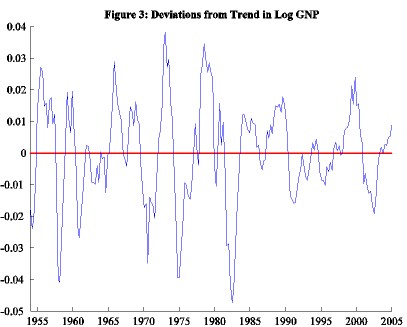

[12] Further econometric studies such as the two works in 2003 and 2007 cited above demonstrate a clear tendency for cyclical components in macroeconomic times to behave in a stochastic rather than deterministic way.

[16][17] Over the period since the Industrial Revolution, technological progress has had a much larger effect on the economy than any fluctuations in credit or debt, the primary exception being the Great Depression, which caused a multi-year steep economic decline.

Notably, in 2003, Robert Lucas Jr., in his presidential address to the American Economic Association, declared that the "central problem of depression-prevention [has] been solved, for all practical purposes.

He who would understand business cycles must master the workings of an economic system organized largely in a network of free enterprises searching for profit.

[26] There is often a close timing relationship between the upper turning points of the business cycle, commodity prices, and freight rates, which is shown to be particularly tight in the grand peak years of 1873, 1889, 1900 and 1912.

Recent research employing spectral analysis has confirmed the presence of Kondratiev waves in the world GDP dynamics at an acceptable level of statistical significance.

Further, Orlando et al.,[39] over an extensive dataset, shown that recurrence quantification analysis may help in anticipating transitions from laminar (i.e. regular) to turbulent (i.e. chaotic) phases such as USA GDP in 1949, 1953, etc.

Last but not least, it has been demonstrated that recurrence quantification analysis can detect differences between macroeconomic variables and highlight hidden features of economic dynamics.

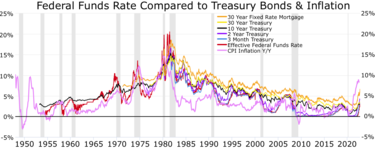

[40] Unlike long-term trends, medium-term data fluctuations are connected to the monetary policy transmission mechanism and its role in regulating inflation during an economic cycle.

Contrarily, in the heterodox tradition of Jean Charles Léonard de Sismondi, Clément Juglar, and Marx the recurrent upturns and downturns of the market system are an endogenous characteristic of it.

[51] According to Keynesian economics, fluctuations in aggregate demand cause the economy to come to short run equilibrium at levels that are different from the full employment rate of output.

While credit causes have not been a primary theory of the economic cycle within the mainstream, they have gained occasional mention, such as (Eckstein & Sinai 1990), cited approvingly by (Summers 1986).

The political business cycle theory is strongly linked to the name of Michał Kalecki who discussed "the reluctance of the 'captains of industry' to accept government intervention in the matter of employment".

[57] Persistent full employment would mean increasing workers' bargaining power to raise wages and to avoid doing unpaid labor, potentially hurting profitability.

In recent years, proponents of the "electoral business cycle" theory have argued that incumbent politicians encourage prosperity before elections in order to ensure re-election – and make the citizens pay for it with recessions afterwards.

[58] The political business cycle is an alternative theory stating that when an administration of any hue is elected, it initially adopts a contractionary policy to reduce inflation and gain a reputation for economic competence.

[60] Some Marxist authors such as Rosa Luxemburg viewed the lack of purchasing power of workers as a cause of a tendency of supply to be larger than demand, creating crisis, in a model that has similarities with the Keynesian one.

Henryk Grossman[61] reviewed the debates and the counteracting tendencies and Paul Mattick subsequently emphasized the basic differences between the Marxian and the Keynesian perspective.

[62] The American mathematician and economist Richard M. Goodwin formalised a Marxist model of business cycles known as the Goodwin Model in which recession was caused by increased bargaining power of workers (a result of high employment in boom periods) pushing up the wage share of national income, suppressing profits and leading to a breakdown in capital accumulation.

Later theorists applying variants of the Goodwin model have identified both short and long period profit-led growth and distribution cycles in the United States and elsewhere.

[63][64][65][66][67] David Gordon provided a Marxist model of long period institutional growth cycles in an attempt to explain the Kondratiev wave.

[68][69] One of the criticisms of the Austrian business cycle theory is based on the observation that the United States suffered recurrent economic crises in the 19th century, notably the Panic of 1873, which occurred prior to the establishment of a U.S. central bank in 1913.

When the yield curve is upward sloping, banks can profitably take-in short term deposits and make long-term loans so they are eager to supply credit to borrowers.

Since the 1960s, economists like Nobel Laureates Milton Friedman and Edmund Phelps have made ground in their arguments that inflationary expectations negate the Phillips curve in the long run.

Friedman has gone so far as to argue that all the central bank of a country should do is to avoid making large mistakes, as he believes they did by contracting the money supply very rapidly in the face of the Wall Street crash of 1929, in which they made what would have been a recession into the Great Depression.