Real-estate bubble

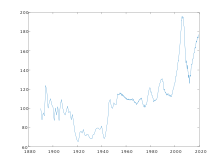

[1] A land boom is a rapid increase in the market price of real property such as housing until they reach unsustainable levels and then declines.

The questions of whether real estate bubbles can be identified and prevented, and whether they have broader macroeconomic significance, are answered differently by schools of economic thought, as detailed below.

Housing price busts are less frequent, but last nearly twice as long and lead to output losses that are twice as large (IMF World Economic Outlook, 2003).

As with other medium and long range economic trends, accurate prediction of future bubbles has proven difficult.

The pre-dominating economic perspective is that increases in housing prices result in little or no wealth effect, namely it does not affect the consumption behavior of households not looking to sell.

The burden of repaying or defaulting on the loan depresses aggregate demand, it is argued, and constitutes the proximate cause of the subsequent economic slump.

In attempting to identify bubbles before they burst, economists have developed a number of financial ratios and economic indicators that can be used to evaluate whether homes in a given area are fairly valued.

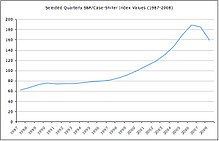

A noted series of HPIs for the United States are the Case–Shiller indices, devised by American economists Karl Case, Robert J. Shiller, and Allan Weiss.

[27] Then U.S. Federal Reserve Chairman Alan Greenspan said in mid-2005 that "at a minimum, there's a little 'froth' (in the U.S. housing market) … it's hard not to see that there are a lot of local bubbles.

As a result, banks have become less willing to hold large amounts of property-backed debt, likely a key issue affecting the worldwide recovery in the short term.

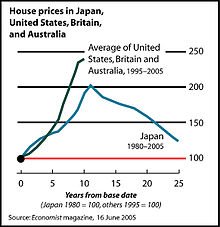

By 2006, most areas of the world were thought to be in a bubble state, although this hypothesis, based upon the observation of similar patterns in real estate markets of a wide variety of countries,[34] was subject to controversy.

'"[38] Other recent research indicates that mid-level managers in securitized finance did not exhibit awareness of problems in overall housing markets.

[41][42] Due to the policies of QE3, mortgage interest rates have been hovering at an all-time low, causing real estate values to rise.

This shortage, coupled with increased borrowing costs due to the Federal Reserve's interest rate hikes, contributed to the soaring prices.

Experts note that the current price increases are based on market fundamentals rather than speculative behavior, highlighting the ongoing issue of housing affordability.