Royal Bank of Scotland

[5] The bank traces its origin to the Society of the Subscribed Equivalent Debt, which was set up by investors in the failed Company of Scotland to protect the compensation they received as part of the arrangements of the 1707 Acts of Union.

[9] Further branches were opened in Dundee, Rothesay, Dalkeith, Greenock, Port Glasgow, and Leith in the first part of the nineteenth century.

An axial banking hall (Telling Room) behind the building, designed by John Dick Peddie, was added in 1857; it features a domed roof, painted blue internally, with gold star-shaped coffers.

[12] The expansion of the British Empire in the latter half of the nineteenth century saw the emergence of London as the largest financial centre in the world, attracting Scottish banks to expand southward into England.

However, the British government referred both bids to the Monopolies and Mergers Commission; both were subsequently rejected as being against the public interest.

[17] Following the implosion of the Royal Bank of Scotland in 2008 while under the direction of directors at its Edinburgh headquarters, and its rescue by taxpayer funds, it became a subsidiary of the UK Government.

On 20 January 2011, Royal Bank of Scotland were fined £28.58 million for anti-competitive practices that were enacted with Barclays in relation to the pricing of loan products for large professional services firms.

[20] Royal Bank of Scotland released a statement on 12 June 2013 that announced a transition in which CEO Stephen Hester would stand down in December 2013 for the financial institution "to return to private ownership by the end of 2014".

[21] Hester was replaced as CEO by New Zealander Ross McEwan, formerly the head of the bank's retail arm, on 1 October 2013.

[22] McEwan, who was 56 years old at the start of his tenure, will receive no bonus for his work in 2013 or at the end of 2014, and his pension will be replaced by an annual cash sum equivalent to 35 percent of his salary as CEO.

[24] It was also announced in that month that the bank was in talks to sell its equity derivatives business to a buyer rumoured to be BNP Paribas.

[25] In September 2014, Royal Bank of Scotland announced that they would move their headquarters to London in the event of a Yes vote in the Scottish referendum.

The sale includes client relationships managed under Coutts and Adam and Company brands in Switzerland, Monaco, the UAE, Qatar, Singapore and Hong Kong.

[27] On 20 March 2017, the British paper The Guardian reported that hundreds of banks had helped launder KGB-related funds out of Russia, as uncovered by an investigation named Global Laundromat.

Adam and Company continued as an RBS private banking brand in Scotland, along the same lines as the Messrs. Drummond and Child & Co. businesses in England.

Child & Co. also closed in 2022, leaving Messrs. Drummond and Holt's Military Banking as the only remaining branches of RBS operating in England and Wales.

The branches were due to be divested from the group in 2016 as a standalone business operating under the Williams & Glyn name,[34] although, in August 2016, RBS cancelled the spin-off plan, stating that the new bank could not survive independently.

[36] A final agreement, known as the "Alternative Remedies Package", was reached with the European Commission in September 2017, allowing RBS Group to retain the Williams & Glyn assets and bringing the sale process to a close.

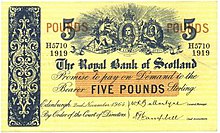

[41] The £5 note features Nan Shepherd on the obverse accompanied by a quote from her book 'The Living Mountain', and the Cairngorms in the background.

It shows Mary Somerville on the obverse, with a quote from her work 'The Connection of the Physical Sciences', and Burntisland beach in the background.

Occasionally the Royal Bank of Scotland issues special commemorative banknotes to mark particular occasions or to celebrate famous people.

[53] In 2006, The Royal Bank of Scotland Group undertook the first trial of PayPass contactless debit and credit cards in Europe.

It is a member of the Financial Ombudsman Service, UK Payments Administration and of the British Bankers' Association; it subscribes to the Lending Code.

In spring 2014 the full bank name returned to print and television advertising in the form of a new logo with the omission of "The".

Royal Bank of Scotland helped to provide an estimated £8 billion from 2006 to 2008 to the energy corporation E.ON and other coal-utilizing companies.

[61] In 2012, 2.8% of Royal Bank of Scotland' total lending was provided to the power, oil and gas sectors combined.

The UK Government bought Royal Bank of Scotland stock for £42 billion, representing 50 pence per share.

[68] RBS' central role in the financial crisis led to it being targeted by a protest camp, 'Occupy Edinburgh', who set-up outside their Head Branch on St. Andrews Square in October 2011.

The camp was maintained for 108 days and included a number of rallies and protests, as well as a pirate flag being raised on top of the RBS head branch.

[70] In October 2016, BBC Newsnight and Buzzfeed published reports from a leaked internal document which showed that RBS had "Systematically Crushed British Businesses"[71] with fines, interest rate hikes and loan withdrawals, often acquiring equity or property at firesale prices, turning a sizeable profit.