Rust Belt

Demand for coal declined as industry turned to oil and natural gas, and U.S. steel was undercut by German and Japanese firms.

The U.S. automotive industry declined as consumers turned to fuel-efficient, imported vehicles after the 1973 oil crisis raised the cost of gasoline, and when foreign manufacturers opened factories in the U.S., they largely avoided the strongly unionized Rust Belt.

Major Rust Belt cities include Baltimore, Buffalo, Chicago, Cincinnati, Cleveland, Detroit, Milwaukee, Philadelphia, Pittsburgh, Rochester, and St.

[8] The flourishing industrial manufacturing in the region was caused in part by the proximity to the Great Lakes waterways, and abundance of paved roads, water canals, and railroads.

Soon it developed into the Factory Belt with its manufacturing cities: Chicago, Buffalo, Detroit, Milwaukee, Cincinnati, Toledo, Cleveland, St. Louis, Youngstown, and Pittsburgh, among others.

This region for decades served as a magnet for immigrants from Austria-Hungary, Poland, and Russia, as well as Yugoslavia, Italy, and the Levant in some areas, who provided the industrial facilities with inexpensive labor.

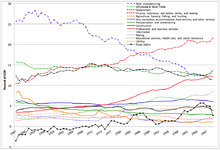

[12] From 1987 to 1999, the U.S. stock market went into a stratospheric rise, and this continued to pull wealthy foreign money into U.S. banks, which biased the exchange rate against manufactured goods.

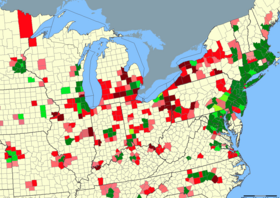

Related issues include the decline of the iron and steel industry, the movement of manufacturing to the southeastern states with their lower labor costs,[13] the layoffs due to the rise of automation in industrial processes, the decreased need for labor in making steel products, new organizational methods such as just-in-time manufacturing which allowed factories to maintain production with fewer workers, the internationalization of American business, and the liberalization of foreign trade policies due to globalization.

[14] Cities struggling with these conditions shared several difficulties, including population loss, lack of education, declining tax revenues, high unemployment and crime, drugs, swelling welfare rolls, deficit spending, and poor municipal credit ratings.

The extent to which a community may have been described as a "Rust Belt city" depends on how great a role industrial manufacturing played in its local economy in the past and how it does now, as well as on perceptions of the economic viability and living standards of the present day.

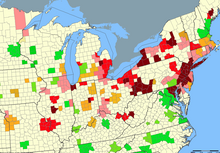

[22] At the center of this expanse lies an area stretching from northern Indiana and southern Michigan in the west to Upstate New York in the east, where local tax revenues as of 2004[update] relied more heavily on manufacturing than on any other sector.

A gate was opened between a variety of burgeoning industries on the interior North American continent and the markets of large East Coast cities and Western Europe.

The northern cities experienced changes that followed the end of World War II, with the onset of the outward migration of residents to newer suburban communities,[29] and the declining role of manufacturing in the American economy.

[26][32] On June 26, 2009, Jeff Immelt, CEO of General Electric, called for the U.S. to increase its manufacturing base employment to 20% of the workforce, commenting that the U.S. has outsourced too much in some areas and can no longer rely on the financial sector and consumer spending to drive demand.

Closed companies no longer order goods and services from local non-manufacturing firms and former industrial workers may be unemployed for years or permanently.

Other work by this team of economists, with Daron Acemoglu and Brendan Price, estimates that competition from Chinese imports cost the U.S. as many as 2.4 million jobs in total between 1999 and 2011.

[43] In 2010, Paul Krugman called for a general tariff rate of 25% on all Chinese products to halt the deindustrialization of the United States and the offshoring of American industries and factories to China.

… The decline is readily measurable in statistics on crime, fatherless children, broken trust, reduced opportunities for and outcomes from education, and the like".

[50] Problems associated with the Rust Belt persist even today, particularly around the eastern Great Lakes states, and many once-booming manufacturing metropolises dramatically slowed down.

[54] In the late 2000s, American manufacturing recovered faster from the Great Recession of 2008 than the other sectors of the economy,[56] and a number of initiatives, both public and private, are encouraging the development of alternative fuel, nano and other technologies.

[60] Different strategies were proposed in order to reverse the fortunes of the former Factory Belt including building casinos and convention centers, retaining the creative class through arts and downtown renewal, encouraging the knowledge economy type of entrepreneurship, and other steps.

This includes growing new industrial base with a pool of skilled labor, rebuilding the infrastructure and infrasystems, creating research and development-focused university-business partnerships, and close cooperation between central, state and local government, and business.

[61] New types of research and development-intensive nontraditional manufacturing have emerged recently in the Rust Belt, including biotechnology, the polymer industry, infotech, and nanotech.

The turnaround was accomplished in part by a partnership between Goodyear Tire & Rubber Company, which chose to stay, the University of Akron, and the city mayor's office.

A core plot device of both is the economic, social, and population decline[69] facing the fictional Western Pennsylvanian town of Buell, itself brought about by thorough de-industrialization typical of the region.