Sky Group

Sky Group Limited[4] is a British media and telecommunications conglomerate owned by Comcast and headquartered in London.

Sky is Europe's largest media company and pay-TV broadcaster by revenue (as of 2018[update]),[5] with 23 million subscribers and more than 31,000 employees as of 2019.

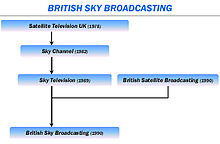

[12] The merger was investigated by the Office of Fair Trading[13] and was cleared a month later since many of the represented views were more concerned about contractual arrangements which had nothing to do with competition.

[17] Sam Chisholm was appointed CEO[18] in a bid to reorganise the new company, which, continued to make losses of £10 million per week.

[19] Chisholm also renegotiated the merged company's expensive deals with the Hollywood studios, slashing the minimum guaranteed payments.

ITV also asked the Office of Fair Trading to also investigate since it believed Rupert Murdoch's media empire via the newspapers had influenced the deal.

[32] Following a lengthy legal battle with the European Commission, which deemed the exclusivity of the rights to be against the interests of competition and the consumer, BSkyB's monopoly came to an end from the 2007–08 season.

[35] The stock flotation reduced Murdoch's holding to 40 per cent and raised £900m, which allowed the company to cut its debt in half.

BSkyB entered the FTSE 100 index, operation profits increased to £155M a year, and Pearson sold off its 17.5% stake in the company.

In June, it was awarded the right to start the service, ONdigital, under the condition BSkyB withdrew from the group's bid.

"[46] In early 2007 Freeview overtook Sky Digital with nearly 200,000 more subscribers at the end of 2006, while cable broadcaster Virgin Media had three million customers.

However, following the News International phone hacking scandal, critics and politicians began to question the appropriateness of the proposed takeover.

[54] In September 2012, Ofcom ruled that BSkyB was still fit to hold broadcast licenses in the UK, but criticised James Murdoch's handling of the scandal.

[59] On 9 December 2016, 21st Century Fox announced that it had made an offer to acquire the remainder of Sky plc for £11.7 billion at a value of £10.75 per-share.

However, the regulator did deem that a Fox-owned Sky would be "fit and proper" to hold broadcast licences, despite the recent sexual harassment controversies that had emerged at the US Fox News Channel, as there was no evidence to the contrary.

[65] The Walt Disney Company announced on 14 December 2017 that it would acquire 21st Century Fox, including its stake in Sky plc but barring specific US assets.

Analysts suggested that Disney's proposed transaction could ease regulatory concerns over Fox's purchase of Sky, as the company will eventually lose its ties to the Murdoch family.

[67] A preliminary report by the Competition and Markets Authority issued January 2018 called for the insulation or outright divestment of Sky News as a condition of the purchase, so that it is editorially independent from the Murdoch family.

[69][70] In February 2018, Fox proposed the establishment of an independent editorial board, and committing to fund the network for at least 10 years.

[73] A bidding war began 25 April 2018, when the competing US media and telecoms conglomerate Comcast (owner of NBCUniversal), announced a counter-offer for Sky at £12.50 per-share, or approximately £22.1 billion.

[78] On 5 June 2018, Culture Secretary Matt Hancock cleared both 21st Century Fox and Comcast's respective offers to acquire Sky plc.

[79][80] On 12 June 2018, Comcast announced a US$65 billion counter-offer to acquire the 21st Century Fox assets that Disney had offered to purchase.

[82] On 15 June 2018, the European Commission gave antitrust clearance to Comcast's offer to purchase Sky, citing that in terms of their current assets in Europe, there would be limited impact on competition.

On 26 September 2018, Fox subsequently announced its intent to sell all of its shares in Sky plc to Comcast for £12 billion.

[98] On 12 October 2018, Comcast announced it would compulsorily acquire the rest of Sky after its bid gained acceptances from 95.3% of the broadcaster's shareholders with the company being delisted by early 2019.

[100] In August 2021, Sky Group signed a deal with ViacomCBS to launch Paramount+ in the United Kingdom, Ireland, Italy, Germany, Switzerland and Austria by 2022.

[105] In January 2021, it was announced that Darroch would be standing down as CEO, and will become executive chairman of Sky for the remainder of 2021, and will then be an advisor to the company.

[130][131] The merger was effectively blocked by BSkyB on 17 November 2006 when it controversially bought a 17.9% stake in ITV plc for £940 million,[132] a move that attracted anger from NTL shareholder Richard Branson[133] and an investigation from media and telecoms regulator Ofcom.

NTL stated that it had withdrawn its attempt to buy ITV plc, citing that it did not believe that there was any possibility to make a deal on favourable terms.