Social Security debate in the United States

[6][7] In addition, on February 18, 2010, President Obama issued an executive order mandating the creation of the bipartisan National Commission on Fiscal Responsibility and Reform,[8] which made ten specific recommendations to ensure the sustainability of Social Security.

[37] In a survey of 210 members of the American Economics Association published in November 2006, 85 percent agreed with the statement: "The gap between Social Security funds and expenditures will become unsustainably large within the next fifty years if current policies remain unchanged.

[47] The Center on Budget and Policy Priorities wrote in 2010: "The 75-year Social Security shortfall is about the same size as the cost, over that period, of extending the 2001 and 2003 tax cuts for the richest 2 percent of Americans (those with incomes above $250,000 a year).

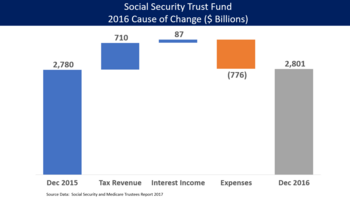

"[48] Because Social Security tax receipts and interest exceed payments, the program also reduces the size of the annual federal budget deficit commonly reported in the media.

The New York Times wrote in January 2009 that Social Security and Medicare "have proved almost sacrosanct in political terms, even as they threaten to grow so large as to be unsustainable in the long run".

In the United States in the late 1990s, privatization found advocates who complained that U.S. workers, paying compulsory payroll taxes into Social Security, were missing out on the high rates of return of the U.S. stock market (the Dow averaged 5.3% compounded annually for the 20th century[59]).

But in the meantime, several conservative and libertarian organizations that considered it a crucial issue, such as The Heritage Foundation and Cato Institute, continued to lobby for some form of Social Security privatization.

[68] In his 2006 State of the Union speech, he described entitlement reform (including Social Security) as a "national challenge" that, if not addressed timely, would "present future Congresses with impossible choices – staggering tax increases, immense deficits, or deep cuts in every category of spending".

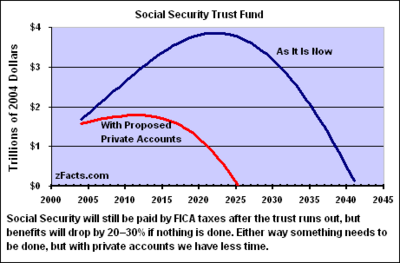

[74] The Social Security public trustees including Charles Blahous warned in May 2013 that the "window for effective action" to take place was "rapidly closing", with less favorable options available to rectify the problems as time passes.

The changes approved by President Reagan in 1983 were phased in over time and included raising the retirement age from 65 to 67, taxation of benefits, cost of living adjustment (COLA) delays, and inclusion of new federal hires in the program.

These are measured over a 75-year period and infinite horizon by the program's Trustees: The CBO estimated in January 2012 that raising the full retirement age for Social Security from 67 to 70 would reduce outlays by about 13%.

His website indicated that he "will work with members of Congress from both parties to strengthen Social Security and prevent privatization while protecting middle-class families from tax increases or benefit cuts.

According to the CBO: "Many analysts believe that the CPI-W overstates increases in the cost of living because it does not fully account for the fact that consumers generally adjust their spending patterns as some prices change relative to others".

However, CBO also reported that: "CPI-E, an experimental version of the CPI that reflects the purchasing patterns of older people, has been 0.3 percentage points higher than the CPI-W over the past three decades".

The San Francisco Chronicle gave this explanation: Under Pozen's plan, which is likely to be significantly altered even if the concept remains in legislation, all workers who earn more than about $25,000 a year would receive some benefit cuts.

Gary Thayer, chief economist for A. G. Edwards, has been cited in the mainstream media saying that the cost of privatizing—estimated by some at $1 trillion to $2 trillion—would worsen the federal budget deficit in the short term, and "That's not something I think the credit markets would appreciate".

The proponents' argument is that projected returns (higher than those individuals currently receive from Social Security) and ownership of the private accounts would allow lower spending on the guaranteed benefit, but possibly without any net loss of income to beneficiaries.

Liberal economists like Peter Orszag and Joseph Stiglitz have argued that Social Security is already perceived as enough of a forced savings program to preclude a reduction in the labor supply.

The Heritage Foundation, a conservative think tank, calculates that a 40-year-old male with an income just under $60,000, will contribute $284,360 in payroll taxes to the Social Security Trust Fund over his working life, and can expect to receive $2,208 per month in return under the current program.

Supporters of the current system argue that the long-term trend of U.S. securities markets cannot safely be extrapolated forward, because stock prices relative to earnings are already at very high levels by historical standards.

Michael Kinsley has said that there would be no net new funds for investment, because any money diverted into private accounts would produce a dollar-for-dollar increase in the federal government's borrowing from other sources to cover its general deficit.

After a phase-in period, workers currently less than 55 years old would have the option to set aside four percentage points of their payroll taxes in individual accounts that could be invested in the private sector, in "a conservative mix of bonds and stock funds".

[138] In his speech, Bush did not address the issue of how the system would continue to provide benefits for current and near-future retirees if some of the incoming Social Security tax receipts were to be diverted into private accounts.

The issue gained increasing political scrutiny since George W. Bush mentioned changing Social Security during the 2004 elections, and since he made it clear in his nationally televised January 2005 speech that he intended to work to partially privatize the system during his second term.

To assist the effort, Republican donors were asked after the election to help raise $50 million or more for a campaign in support of the proposal, with contributions expected from such sources as the fiscally conservative 501(c)4 organization Club for Growth and the securities industry.

In Denver, for example, three people who had obtained tickets through Representative Bob Beauprez, a Republican, were nevertheless ejected from the meeting before Bush appeared, because they had arrived at the event in a car with a bumper sticker reading "No More Blood for Oil".

Specific proposals that received more support than opposition (in each case by about a two-to-one ratio) were "Limiting benefits for wealthy retirees" and "Requiring higher income workers to pay Social Security taxes on ALL of their wages".

[151] In late May 2005, House Majority Whip Roy Blunt listed the "priority legislation" to be acted on after Memorial Day; Social Security was not included,[152] and Bush's proposal was considered by many to be dead.

"[161] His comment is consonant[citation needed] with the Cato Institute's reference in 1983 to a "Leninist strategy" for "guerrilla warfare" against both the current Social Security system and the coalition that supports it.

The party leadership on both sides of the aisle have chosen not to frame the debate in this manner, presumably because of the unpleasantness involved in arguing that current retirees would have a much higher quality of life if Social Security legislation mandated returns that were merely similar to the interest rate the U.S. government pays on its borrowings.