Banknotes of Zimbabwe

[2] The Reserve Bank of Zimbabwe issued most of the banknotes and other types of currency notes in its history, including the bearer cheques and special agro-cheques ("agro" being short for agricultural) that circulated between 15 September 2003 and 31 December 2008: the Standard Chartered Bank also issued their own emergency cheques from 2003 to 2004.

[6] The economic and trade sanctions imposed against the Zimbabwean government and the Reserve Bank made it difficult to incorporate modern security features on most banknotes issued since September 2008.

[7][8] However, the Reserve Bank reintroduced local banknotes the following year, due to a shortage of hard currencies such as the United States dollar.

The first series of banknotes ranged from $2 to $20, and carried the signature of Dr. Desmond Krogh, then the last Governor of the Reserve Bank of Rhodesia from 1973.

[2][10] From 1994 to 1997 the Reserve Bank issued a new series of notes ranging from $2 to $100, although the $2 banknote was withdrawn and replaced by a coin in 1997.

[11] As rising inflation started to affect the purchasing power of the Zimbabwean Dollar, the $500 and $1000 banknotes were issued from 2001 to 2005 with enhanced anti-counterfeiting measures.

[12] In May 2003, the Reserve Bank allowed the Cargill Cotton Group to issue emergency bearer cheques to cotton farmers, via a Standard Chartered Zimbabwe branch in Harare: Cargill issued these cheques due to a shortage of money caused by high annual inflation, which according to The Herald, was around 269.2% in June 2003.

[15][13] These, and subsequent issues of the first and second dollars were time limited and lacked sophisticated anti-counterfeiting measures which were heavily used in many modern banknotes such as those of the Swiss Franc.

The time limits were either ignored or extended by multiple decrees, meaning that all notes of these issues remained legal tender in practice until 21 August 2006.

[17] The redenomination (codenamed Operation Sunrise) was heavily publicised under the banner Zero to Hero, but was also rapid and disorganised which resulted in many people being unable to convert their old Bearer cheques to new issues before the lapse date,[16] The Reserve Bank Governor Dr. Gideon Gono said that "10 trillion (first dollars) were still out there and it had become manure".

In the final months of the second dollar, the $200000 cheque was the lowest legal tender denomination by decree, despite having its expiry date extended twice.

[19] Munich-based security printers Giesecke & Devrient ceased providing banknote paper to the Reserve Bank on 1 July 2008 in response to an official request from the German government and widespread calls for sanctions;[21] The Jura JSP software end-user licence, issued to the state-owned Fidelity Printers & Refiners was also terminated on 24 July 2008 for similar reasons although the official press statement quoted that it was de facto impossible to prevent the printers from using the software.

[28] The 1980 series consisted of four denominations: $2, $5, $10 and $20 – and made extensive use of the Guilloché technique, a security feature common on many banknotes from the 1980s.

The obverse also had a flower at centre, a solid element with a latent image of the letters "RBZ", and tactile marks for the visually impaired.

The watermark of the Zimbabwe Bird had a long neck, while the security thread was demetalised with the letters "RBZ" and the denomination.

[36] In May 2003, the Reserve Bank allowed the Cargill Cotton Group to issue emergency bearer cheques to cotton farmers, via a Standard Chartered Zimbabwe branch in Harare: Cargill issued these cheques due to a shortage of money caused by high annual inflation, which according to The Herald, was around 269.2% in June 2003.

[40][41] The Zimbabwean dollar was first redenominated on 1 August 2006 under a currency reform campaign codenamed Operation Sunrise and involving the motto Zero to Hero.

[44] Two variations that were issued for the $10000 and $100000 denominations are recognised in the Standard Catalog of World Paper Money: the difference between them was the use of digit grouping.

They had a different design, and they were intended for use only by farmers: however, Zimbabweans treated them as regular money, because of the continued hyperinflation, and their similar function to bearer cheques.

The 2007 banknote series was prepared by the Reserve Bank in October 2006 for the abandoned second phase of Operation Sunrise.

[63] A silhouette of the Zimbabwe Bird in Optically Variable Ink was used in such notes to compensate for this, but the iridescent strip was dropped for higher denominations.

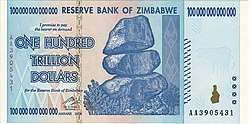

Hyperinflationary Zimbabwean banknotes (such as the $100 trillion denomination) have gained considerable interest from the numismatic community and buyers in general for their absurdity rather than for their designs.

[83] In 2011, House Budget Committee Chairman Paul Ryan and Stanford University economist John B. Taylor were said to keep Z$100 trillion notes in their wallets as a physical reminder of the perils of hyperinflation.

[86] Similar to the Iraqi dinar scam, some promoters are claiming that a future "revalue" (RV) event will cause Zimbabwe dollar notes to regain some nonzero fraction of their original value.

[88] Businesses, including Western Union, have been reported paying employees with these coupons, and even auctions have been transacted in this currency.

[89] As with much Zimbabwe currency, printing standards are crude and counterfeiting is rampant; the RBZ has been dissuading this widespread use.