Stock-flow consistent model

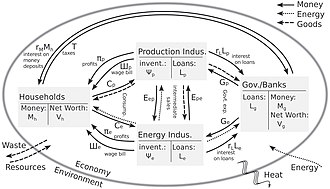

Stock-flow consistent models (SFC) are a family of non-equilibrium macroeconomic models based on a rigorous accounting framework, that seeks to guarantee a correct and comprehensive integration of all the flows and the stocks of an economy.

These models were first developed in the mid-20th century but have recently become popular, particularly within the post-Keynesian school of thought.

The ideas for an accounting approach to macroeconomics go back to Knut Wicksell,[3] John Maynard Keynes (1936)[4] and Michał Kalecki.

He developed a set of tables to show the relationship between flows of income and expenditure and changes to the stocks of outstanding debt and financial assets held in the US economy.

[1][8] James Tobin and his collaborators used features of stock-flow consistent modelling including the social accounting matrix and discrete time to develop a macroeconomic model that integrated financial and non-financial variables.

[1] He outlined the following distinguishing features of his approach in his Nobel lecture[9] Also Robert Clower based his Keynesian price and business cycle theories on stock-flow relations.

[13] The current SFC models mainly emerged from the separate economic tradition of the Post Keynesians, Wynne Godley being the most famous contributor in this regard.

[1] Godley argued in favour of wider adoption of stock-flow consistent methods, expressing the view that they would improve the transparency and logical coherence of most macro models.

[18][19] By respecting accounting constraints, "black holes" have to be avoided, where money vanishes without an offsetting entry in the balance sheet.

[22][23] Wynne Godley, one of the pioneers of the SFC approach since the 1970s,[22][24] had warned since 2000 in publications[25][26] that the US housing market would weaken and cause a recession.

[22] In DSGE models, which dominate macroeconomics, crises usually cannot arise because of behavioural assumptions such as rational expectations and intertemporal optimisation.

[23][27] Therefore, attempts are made to analyse financial crises using stock-flow consistent models based on the accounting approach.

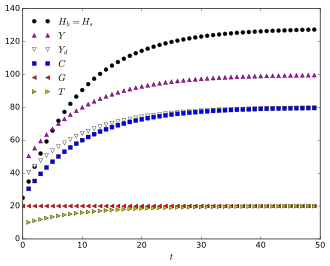

SFC models usually consist of two main components: an accounting part and a set of equations describing the laws of motion of the system.

[20][39] Simple models can be solved analytically and investigated by means of concepts of dynamical system theory such as bifurcation analysis.

Once the accounting framework is fulfilled then the structure of the model, based on stylized facts, is defined.

The set of equations in the model defines relationship between different variables, not determined by the accounting framework.