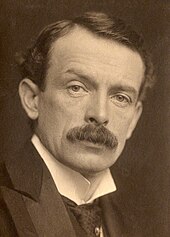

John Maynard Keynes

According to Skidelsky, the sense of cultural unity current in Britain from the 19th century to the end of World War I provided a framework with which the well-educated could set various spheres of knowledge in relation to each other and life, enabling them to confidently draw from different fields when addressing practical problems.

It involved the radical writing down of war debts, which would have had the possible effect of increasing international trade all round, but at the same time thrown over two-thirds of the cost of European reconstruction on the United States.

He wrote, "For Government borrowing of one kind or another is nature's remedy, so to speak, for preventing business losses from being, in so severe a slump as the present one, so great as to bring production altogether to a standstill.

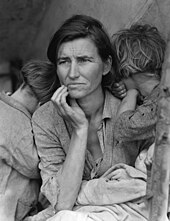

"[48] At the height of the Great Depression, in 1933, Keynes published The Means to Prosperity, which contained specific policy recommendations for tackling unemployment in a global recession, chiefly counter-cyclical public spending.

Classical economists had believed in Say's law, which, simply put, states that "supply creates its demand", and that in a free-market workers would always be willing to lower their wages to a level where employers could profitably offer them jobs.

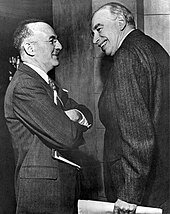

[32][56] Keynes began to recover in 1939, but for the rest of his life his professional energies were directed largely towards the practical side of economics: the problems of ensuring optimum allocation of resources for the war efforts, post-war negotiations with America, and the new international financial order that was presented at the Bretton Woods Conference.

[11][12] In the Daily Mail of 13 March 1931, he called the assumption of perfect sectoral labour mobility "nonsense" since it states that a person made unemployed contributes to a reduction in the wage rate until he finds a job.

[13] He notes in National Self-Sufficiency:[13][11] A considerable degree of international specialization is necessary in a rational world in all cases where it is dictated by wide differences of climate, natural resources, native aptitudes, level of culture and density of population.

In the words of Geoffrey Crowther, then editor of The Economist, "If the economic relationships between nations are not, by one means or another, brought fairly close to balance, then there is no set of financial arrangements that can rescue the world from the impoverishing results of chaos.

[56] While economists and policymakers had become increasingly won over to Keynes's way of thinking in the mid and late 1930s, it was only after the outbreak of World War II that governments started to borrow money for spending on a scale sufficient to eliminate unemployment.

As the key 1968 event Elliott and Atkinson picked out America's suspension of the conversion of the dollar into gold except on request of foreign governments, which they identified as the beginning of the breakdown of the Bretton Woods system.

[101][102][103] Other prominent economic commentators who have argued for Keynesian government intervention to mitigate the 2007–2008 financial crisis included George Akerlof,[104] J. Bradford DeLong,[105] Robert Reich[106] and Joseph Stiglitz.

[109] A series of major bailouts were pursued during the 2007–2008 financial crisis, starting on 7 September 2008 with the announcement that the US Government was to nationalise the two government-sponsored enterprises which oversaw most of the US subprime mortgage market – Fannie Mae and Freddie Mac.

In October, Alistair Darling, the British Chancellor of the Exchequer, referred to Keynes as he announced plans for substantial fiscal stimulus to head off the worst effects of recession, in accordance with Keynesian economic thought.

In February 2009 Robert J. Shiller and George Akerlof published Animal Spirits, a book where they argue the current US stimulus package is too small as it does not take into account Keynes's insight on the importance of confidence and expectations in determining the future behaviour of businesspeople and other economic agents.

In the March 2009 speech entitled Reform the International Monetary System, Zhou Xiaochuan, the governor of the People's Bank of China, came out in favour of Keynes's idea of a centrally managed global reserve currency.

Some leaders and institutions, such as Angela Merkel[123] and the European Central Bank,[124] expressed concern over the potential impact on inflation, national debt and the risk that a too-large stimulus will create an unsustainable recovery.

Although many economists, such as George Akerlof, Paul Krugman, Robert Shiller and Joseph Stiglitz, supported Keynesian stimulus, others did not believe higher government spending would help the United States economy recover from the Great Recession.

[134] Keynes's speech at the closing of the Bretton Woods negotiations was received with a lasting standing ovation, rare in international relations, as the delegates acknowledged the scale of his achievements made despite poor health.

At such moments, I often find myself thinking that Keynes must be one of the most remarkable men that have ever lived – the quick logic, the birdlike swoop of intuition, the vivid fancy, the wide vision, above all the incomparable sense of the fitness of words, all combine to make something several degrees beyond the limit of ordinary human achievement.

When I argued with him, I felt that I took my life in my hands, and I seldom emerged without feeling something of a fool.Keynes's obituary in The Times included the comment: "There is the man himself – radiant, brilliant, effervescent, gay, full of impish jokes ...

In the "red 1930s", many young economists favoured Marxist views, even in Cambridge,[32] and while Keynes was engaging principally with the right to try to persuade them of the merits of more progressive policy, the most vociferous criticism against him came from the left, who saw him as a supporter of capitalism.

Your greatest danger is the probable practical failure of the application of your philosophy in the United States.On the pressing issue of the time, whether deficit spending could lift a country from depression, Keynes replied to Hayek's criticism[141] in the following way: I should... conclude rather differently.

When it comes to a showdown, scarce four weeks have passed before they remember that they are pacifists and write defeatist letters to your columns, leaving the defence of freedom and civilisation to Colonel Blimp and the Old School Tie, for whom Three Cheers.Keynes's early romantic and sexual relationships were exclusively with men.

[35] Among Keynes's Bloomsbury friends, Lopokova was, at least initially, subjected to criticism for her manners, mode of conversation and supposedly humble social origins – the last of the ostensible causes being particularly noted in the letters of Vanessa and Clive Bell, and Virginia Woolf.

[c][21]: 520–521, 563–565 Keynes managed the endowment of King's College, Cambridge starting in the 1920s, initially with an unsuccessful strategy based on market timing but later shifting to focus in the publicly traded stock of small and medium-sized companies that paid large dividends.

[188] The active component of his portfolio outperformed a British equity index by an average of 6%[187] to 8% a year over a quarter century, earning him a favourable mention by later investors such as Warren Buffett and George Soros.

[188] Keynes is also regarded as a pioneer of financial diversification as he recognised the importance of holding assets with "opposed risks" as he wrote "since they are likely to move in opposite directions when there are general fluctuations";[190] and also as an early international investor who avoided home country bias by investing substantially in stocks outside the United Kingdom.

A by-election for the seat was to be held due to the illness of an elderly Tory, and the master of Magdalene College had obtained agreement that none of the major parties would field a candidate if Keynes chose to stand.

"[198][199] In 1931 Keynes had the following to say on Leninism:[40]: 300 How can I accept a doctrine, which sets up as its bible, above and beyond criticism, an obsolete textbook [Das Kapital] which I know not only to be scientifically erroneous but without interest or application to the modern world?