Superannuation in Australia

[1] The superannuation guarantee was introduced by the Hawke government to promote self-funded retirement savings, reducing reliance on a publicly funded pension system.

Though there is general widespread support for compulsory superannuation today, at the time of its introduction it was met with strong resistance by small business groups who were fearful of the burden associated with its implementation and its ongoing costs.

[7] In 1992, under the Keating Labor government, the compulsory employer contribution scheme became a part of a wider reform package addressing Australia's retirement income dilemma.

Federal law dictates minimum amounts that employers must contribute to the superannuation accounts of their employees, on top of standard wages or salaries.

[21] As of 1 July 2018, members have also been able to withdraw voluntary contributions made as part of the First Home Super Saver Scheme (FHSS).

Called the "superannuation guarantee" (SG), the contribution percentage as of 2025 is 12 per cent of the employees' ordinary time earnings, generally consisting of salaries/wages, commissions, allowances, but not overtime.

[23] SG is only mandated for employees that generally make more than $450 in a calendar month, or when working more than 30 hours a week for minors and domestic workers.

[24] SG contributions are paid on top of an employee's pay packet, meaning that they do not form part of wage or salaries.

[25][26] (from 1 July) states and territories[a] transitional rate Special rules apply in relation to employers operating "defined benefit" superannuation schemes, which are less common traditional employer funds where benefits are determined by a formula usually based on an employee's final average salary and length of service.

People can make additional voluntary contributions to their superannuation and receive tax benefits for doing so, subject to limits.

[29] Unused concessional contributions cap space can be carried forward from 1 July 2018, if the total superannuation balance is less than $500,000 at the end of 30 June in the previous year.

As superannuation is money invested for a person's retirement, strict government rules prevent early access to preserved benefits except in very limited and restricted circumstances.

[30] In general people can seek early release superannuation for severe financial hardship or on compassionate grounds, such as for medical treatment not available through Medicare.

In 1997, the Howard Liberal government changed the preservation rules to induce Australians to stay in the workforce for a longer period of time, delaying the effect of population ageing.

Employed individuals who have reached preservation but are under age 65 may access up to 10% of their superannuation under the Transition to Retirement (TRIS) pension rules.

[35] RBLs were indexed each year in line with movements in Average Weekly Ordinary Time Earnings published by the Australian Bureau of Statistics.

An actuarial certificate may be required to support the proportion of exempt pension income based on member balances and numbers of days.

In 1996, the federal government imposed a "superannuation surcharge" on higher income earners as a temporary revenue measure.

[43] The Government offsets a maximum of $500 and a minimum of $20, calculated at 15% of a low income earners total superannuation contributions.

Under the U.S.-Australia Income Tax Treaty, there is an opportunity to lawfully avoid U.S. taxation on gains within Australian superannuation funds.

The compounding interest formula is applied against the base amount (the additional income tax liability) for each day of the ECC charge period.

They do not include superannuation co-contributions, structured settlements and orders for personal injury or capital gains tax (CGT) related payments that the member has validly elected to exclude from their non-concessional contributions.

[citation needed] Other than a few very specific provisions in the Superannuation Industry (Supervision) Act 1993 (largely related to investments in assets related to the employer or impacting a self-managed superannuation fund) funds are not subject to specific asset requirements or investment rules.

As a result, superannuation funds tend to invest in a wide variety of assets with a mix of duration and risk/return characteristics.

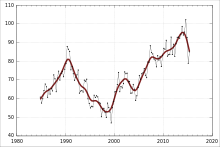

The recent investment performance of superannuation funds compares favourably with alternative assets such as ten year bonds.

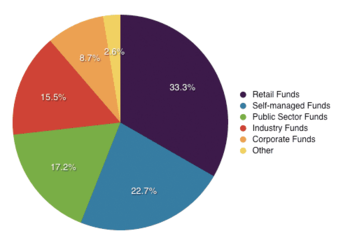

Industry, Retail and Wholesale Master Trusts are the largest sectors of the Australian Superannuation Market by net asset with 217 funds.

The rules cover general areas relating to the trustee, investments, management, fund accounts and administration, enquiries and complaints.

MySuper is part of the Stronger Super[69] reforms announced in 2011 by the Julia Gillard Government for the Australian superannuation industry.

[77] The Australian superannuation industry has been criticised for pursuing self-interested re-investment strategies, and some funds have been accused of choosing investments that benefit related parties ahead of the investor.

In 2018, of Australia's 15 million superannuation fund members, 40% had multiple accounts, which collectively cost them $2.6 billion in additional fees per year.