Surplus value

Marx's term is the German word "Mehrwert", which simply means value added (sales revenue minus the cost of materials used up), and is cognate to English "more worth".

By the Age of Enlightenment in the 18th century the French physiocrats were already writing on the surplus value that was being extracted from labor by "the employer, the owner, and all exploiters" although they used the term net product.

This claim of priority has been vigorously contested, notably in an article by Friedrich Engels, completed by Karl Kautsky and published anonymously in 1887, reacting to and criticizing Menger in a review of his The Right to the Whole Produce of Labour, arguing that there is nothing in common but the term "surplus value" itself.

Johann Karl Rodbertus developed a theory of surplus value in the 1830s and 1840s, notably in Zur Erkenntnis unserer staatswirthschaftlichen Zustände (Toward an appreciation of our economic circumstances, 1842), and claimed earlier priority to Marx, specifically to have "shown practically in the same way as Marx, only more briefly and clearly, the source of the surplus value of the capitalists".

Marx first elaborated his doctrine of surplus value in 1857–58 manuscripts of A Contribution to the Critique of Political Economy (1859), following earlier developments in his 1840s writings.

This form of exploitation was well understood by pre-Marxian Socialists and left-wing followers of Ricardo, such as Proudhon, and by early labor organizers, who sought to unite workers in unions capable of collective bargaining, in order to gain a share of profits and limit the length of the working day.

Marx's own discussion focuses mainly on profit, interest and rent, largely ignoring taxation and royalty-type fees which were proportionally very small components of the national income when he lived.

Assume a general rate of surplus value of this kind, as a tendency, like all economic laws, as a theoretical simplification; but in any case this is in practice an actual presupposition of the capitalist mode of production, even if inhibited to a greater or lesser extent by practical frictions that produce more or less significant local differences, such as the settlement laws for agricultural labourers in England, for example.

The overriding motive behind efforts to economise resources and labor would thus be to obtain the maximum possible increase in income and capital assets ("business growth"), and provide a steady or growing return on investment.

Marx distinguished sharply between value and price, in part because of the sharp distinction he draws between the production of surplus-value and the realisation of profit income (see also value-form).

This insight forms the basis of Marx's theory of market value, prices of production and the tendency of the rate of profit of different enterprises to be levelled out by competition.

In his published and unpublished manuscripts, Marx went into great detail to examine many different factors which could affect the production and realisation of surplus-value.

His main conclusion though is that employers will aim to maximise the productivity of labour and economise on the use of labour, to reduce their unit-costs and maximise their net returns from sales at current market prices; at a given ruling market price for an output, every reduction of costs and every increase in productivity and sales turnover will increase profit income for that output.

In turn, this causes the unit-values of commodities to decline over time, and a decline of the average rate of profit in the sphere of production occurs, culminating in a crisis of capital accumulation, in which a sharp reduction in productive investments combines with mass unemployment, followed by an intensive rationalisation process of take-overs, mergers, fusions, and restructuring aiming to restore profitability.

[citation needed] The lower taxes are, other things being equal, the bigger the mass of profit that can be distributed as income to private investors.

[citation needed] In reality, of course, a substantial portion of tax money is also redistributed to private enterprise in the form of government contracts and subsidies.

[citation needed] Generally, Marx seems to have regarded taxation imposts as a "form" which disguised real product values.

Apparently following this view, Ernest Mandel in his 1960 treatise Marxist Economic Theory refers to (indirect) taxes as "arbitrary additions to commodity prices".

Nevertheless, trading activity outside the sphere of production can obviously also yield a surplus-value which represents a transfer of value from one person, country or institution to another.

Nowadays the volume of world trade grows significantly faster than GDP, suggesting to Marxian economists such as Samir Amin that surplus-value realised from commercial trade (representing to a large extent a transfer of value by intermediaries between producers and consumers) grows faster than surplus-value realised directly from production.

Some Marxian economists argue that Marx thought the possibility of measuring surplus value depends on the publicly available data.

It is always the direct relationship of the owners of the conditions of production to the direct producers – a relation always naturally corresponding to a definite stage of the methods of labour and thereby its social productivity – which reveals the innermost secret, the hidden basis of the entire social structure, and with it the political form of the relation of sovereignty and dependence, in short, the corresponding specific form of the state.

This does not prevent the same economic basis – the same from the standpoint of its main conditions – due to innumerable different, empirical circumstances, natural environment, racial relations, external historical influence, etc.

[16]This is a substantive – if abstract – thesis about the basic social relations involved in giving and getting, taking and receiving in human society, and their consequences for the way work and wealth is shared out.

Ultimately, Thurow implies, the tax department is the arbiter of the profit volume, because it determines depreciation allowances and other costs which capitalists may annually deduct in calculating taxable gross income.

Marx argues there is no evidence that the profit accruing to capitalist owners is quantitatively connected to the "productive contribution" of the capital they own.

In practice, within the capitalist firm, no standard procedure exists for measuring such a "productive contribution" and for distributing the residual income accordingly.

That quest, Marx notes, always involves a power relationship between different social classes and nations, inasmuch as attempts are made to force other people to pay for costs as much as possible, while maximising one's own entitlement or claims to income from economic activity.

The clash of economic interests that invariably results, implies that the battle for surplus value will always involve an irreducible moral dimension; the whole process rests on complex system of negotiations, dealing and bargaining in which reasons for claims to wealth are asserted, usually within a legal framework and sometimes through wars.

Quite simply, economics proved unable to theorise capitalism as a social system, at least not without moral biases intruding in the very definition of its conceptual distinctions.

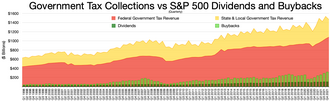

State tax revenue

Federal tax revenue

S&P 500 Stock buyback

S&P 500 Dividends