Tax efficiency

Substitution effect means that the taxpayer changes their preferences as their marginal benefits from the consumption of goods, income, labor, leisure, etc.

We can categorise these costs: Taxes alter the incentives of economic agents and thus affect production decisions.

Higher taxes make goods and services more expensive meaning individuals, firms and governments will search for alternatives.

For example, higher taxes on incomes reduce the incentives of individuals to invest which can have long-term impacts on the productivity of the economy.

[5] The magnitude of deadweight loss depends on the elasticities of supply and demand for the taxed good or service.

Progressive taxes are generally seen as promoting equity and social welfare by reducing income inequality.

This can lead to a decrease in overall economic activity and potential deadweight loss, reducing tax efficiency.

Policymakers need to find a balance between progressivity and efficiency when designing tax systems in order to minimize these trade-offs and maintain economic growth while promoting social welfare.

Policymakers need to devote a lot of attention to designing efficient tax policies and administering them.

Administrative costs are incurred by the government but are eventually borne by the citizens in the form of higher taxes.

Conversely, reducing tax rates too much may lead to insufficient revenue generation, which could negatively impact public services and government functions.

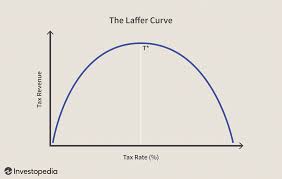

In economics, the Laffer curve is a theoretical relationship between rates of taxation and the resulting levels of the government's tax revenue.

Understanding the mechanism is a great advantage during the times of deficit, since the government needs higher revenue and raising taxes can be seen by some as a solution.

This is due to the fact that taxpayers refuse to pay high taxes to the state and look for alternative solutions (headquarters in other countries, money laundering, shadow economy).

Behavioral responses to taxation can vary widely, depending on factors such as income level, occupation, and the specific type of tax being changed.

Some individuals may adjust their work hours, consumption patterns, or savings and investment strategies in response to tax changes, while others may not respond at all.

Businesses may respond to tax changes by altering their production levels, employment decisions, or pricing strategies.

Understanding these behavioral responses is crucial for policymakers when designing and evaluating tax policies, as the actual impacts of tax changes on revenue generation and economic activity may differ from their intended effects due to these behavioral adjustments.

Researchers often use empirical studies and economic models to estimate these behavioral responses and inform policy decisions.