Poll tax

As prescribed in Exodus, Jewish law imposed a poll tax of a half-shekel, payable by every man above the age of twenty.

16And thou shalt take the atonement money of the children of Israel, and shalt appoint it for the service of the tabernacle of the congregation; that it may be a memorial unto the children of Israel before the LORD, to make an atonement for your souls.The money was designated for the Tabernacle in the Exodus narrative and later for the upkeep of the Temple of Jerusalem.

Zakat al-Fitr is an obligatory charity that must be given by every Muslim (or their guardian) near the end of every Ramadan, except for those in dire poverty.

The Sasanian Persian emperor Nawsherwan imposed a poll tax, termed jizya by Arab historians, varying between 12 and 2 dirhams, exempting officials, soldiers, and nobles.

[12] Although the jizya tax is interpreted by many as a financial humiliation on non-Muslims, others consider it a sign of due allegiance to the political authority of Islam: part of a social contract by which non-Muslims, especially the Jews of Medina, were granted equal social and political rights, and protection of their life, property, and religion.

[13] However, Umar, the second Caliph, ordered a brand on the shoulder of jizya payers, as well as requiring a tonsure and sumptuary laws to distinguish them from Muslims.

[14] Amr ibn al-As, after conquering Egypt, made a census for the jizya according to wealth classes, so that the rich paid more.

[15] The Cairo Geniza records demonstrate the poll tax collection becoming very strict and burdensome for the Jewish community in Egypt during the 12th century.

Evidence suggests that the guardian of a minor was responsible to pay the full poll tax on his behalf until the age of ten.

[16] The treaty of 1535, known as the Franco-Ottoman alliance, revolutionized relations between the Christian and Islamic states, with the poll tax playing a significant role.

ISIS issued the same ultimatum in its capital of Raqqa, Syria, demanding 0.5 ounces (14 g) of pure gold from Christians in exchange for their safety.

The Young Lanka League protested the tax, led by A. Ekanayake Gunasinha, and it was repealed by the Legislative Council of Ceylon in 1925 following a motion submitted by C. H. Z.

The Hilary Parliament, held between January and March 1377, levied a poll tax in 1377 to finance the war against France at the request of John of Gaunt who, since King Edward III was mortally sick, was the de facto head of government at the time.

[24] The 1381 tax has been credited as one of the main reasons behind the Peasants' Revolt in that year, due in part to attempts to restore feudal conditions in rural areas.

With the Restoration of Charles II in 1660, the Convention Parliament of 1660 instituted a poll tax to finance the disbanding of the New Model Army (pay arrears, etc.)

Ultimately, it was the inefficiency of their collection (what they brought in routinely fell far short of expected revenues) that prompted the government to abandon the poll tax after 1698.

The abolition of rates was in the Conservative Party manifesto for the 1979 general election; the replacement was proposed in the Green Paper of 1986, Paying for Local Government based on ideas developed by Dr. Madsen Pirie and Douglas Mason of the Adam Smith Institute.

In Scotland, the APTUs called for mass nonpayment, which rapidly gathered widespread support and spread as far as England and Wales even though non-payment meant that people could be prosecuted.

Terry Fields, Labour MP for Liverpool Broadgreen, was jailed for 60 days for his refusal to pay the poll tax.

Although he felt the policy looked like it would work, it was implemented differently from his predictions "They went gung-ho and introduced it overnight in one go, which was never my plan and I thought they must know what they were doing – but they didn't.

"[33] In France, a poll tax, the capitation of 1695, was first imposed by King Louis XIV in 1695 as a temporary measure to finance the War of the League of Augsburg, and thus repealed in 1699.

Prime Minister Helen Clark offered New Zealand's Chinese community an official apology for the poll tax on 12 February 2002.

Towns in the provinces who possessed the Jus Italicum (enjoying the "privileges of Italy") were exempted from the poll tax.

After the destruction of the temple in 70 AD, the Emperor Vespasian imposed an extra poll tax on Jews throughout the empire, the fiscus judaicus, of two denarii each.

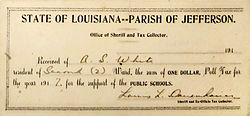

Prior to the mid 20th century, a poll tax was implemented in some U.S. state and local jurisdictions and paying it was a requirement before one could exercise one's right to vote.

[42] The poll tax, along with literacy tests and extra-legal intimidation,[43] such as by the Ku Klux Klan, achieved the desired effect of disenfranchising African Americans.

For example, a bill that passed the Florida House of Representatives in April 2019 has been compared to a poll tax because it requires former felons to pay all "financial obligations" related to their sentence, including court fines, fees, and judgments, before their voting rights will be restored as required by a referendum that passed with 64% of the vote in 2018.

The Revenue Act of 1861 established the first income tax in the United States, to pay for the cost of the American Civil War.

Finally, ratification of the Sixteenth Amendment to the United States Constitution in 1913 made possible modern income taxes, by limiting the Sixteenth Amendment income tax to the class of indirect excises (i.e. excises, duties, and imposts) – thus requiring no apportionment,[48] [49] a practice that would remain unchanged into the 21st century.

Various cities, including Chicago and Denver, have levied head taxes with a set rate per employee targeted at large employers.