Tax policy and economic inequality in the United States

[10] For example, a 2011 Congressional Research Service report stated, "Changes in capital gains and dividends were the largest contributor to the increase in the overall income inequality.

The work of Emmanuel Saez, for example, has concerned the role of American tax policy in aggregating wealth into the richest households in recent years while Thomas Sowell and Gary Becker maintain that education, globalization, and market forces are the root causes of income and overall economic inequality.

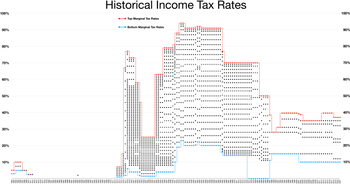

The Revenue Act of 1964 and the "Bush Tax Cuts" coincide with the rising economic inequality in the United States both by socioeconomic class and race.

[13][14][15][16][17] Economists and related experts have described America's growing income inequality as "deeply worrying",[19] unjust,[20] a danger to democracy/social stability,[21][22][23] and a sign of national decline.

[24] Yale professor Robert Shiller, who was among three Americans who won the Nobel prize for economics in 2013, said after receiving the award, "The most important problem that we are facing now today, I think, is rising inequality in the United States and elsewhere in the world.

Unemployment may seriously harm growth because it is a waste of resources, generates redistributive pressures and distortions, depreciates existing human capital and deters its accumulation, drives people to poverty, results in liquidity constraints that limit labor mobility, and because it erodes individual self-esteem and promotes social dislocation, unrest and conflict.

Sociologist and University of California-Santa Cruz professor G. William Domhoff writes that "numerous studies show that the wealth distribution has been extremely concentrated throughout American history" and that "most Americans (high income or low income, female or male, young or old, Republican or Democrat) have no idea just how concentrated the wealth distribution actually is.

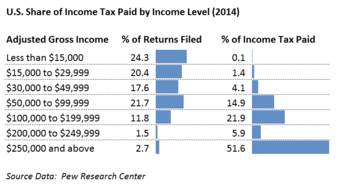

A 2011 Congressional Research Service report stated, "Changes in capital gains and dividends were the largest contributor to the increase in the overall income inequality.

As of the 2013 tax year, all investment income for high earning households will be subject to a 3.8% surtax bringing the top capital gains rate to 23.8%.

Forty-five states, the District of Columbia, the territories of Puerto Rico, and Guam impose general sales taxes on most goods and some services.

[53] Those who do not qualify for such aid can obtain a low-interest student loan, which may be subsidized based on financial need, and tuition can often be deducted from the federal income tax.

[56] However, the cost for college tuition has increased significantly faster than inflation, leading the United States to have one of the most expensive higher education systems in the world.

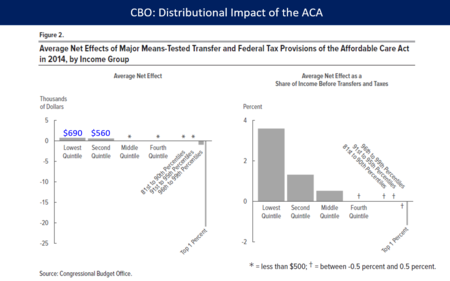

The number of uninsured in the United States, many of whom are the working poor or unemployed, are one of the primary concerns raised by advocates of health care reform.

In 2014, the Patient Protection and Affordable Care Act encourages states to expand Medicaid for low income households, funded by additional federal taxes.

In 2006, the "highest paid hedge fund manager in the United States made an amount equal to the salaries of all 80,000 New York City school teachers for the next three years."

Accordingly, Krugman believes that education and a shifting global market are not the sole causes of increased income inequalities since the 1980s but rather that politics and the implementation of conservative ideology has aggregated wealth to the rich.

[65] Nobel laureate Joseph Stiglitz asserts in a Vanity Fair article published in May 2011 entitled "Of the 1%, by the 1%, for the 1%" that "preferential tax treatment for special interests" has helped increase income inequality in the United States as well as reduced the efficiency of the market.

He specifically points to the reduction in capital gains over the last few years, which are "how the rich receive a large portion of their income," as giving the wealthy a "free ride."

Stiglitz criticizes the "marginal productivity theory" saying that the largest gains in wages are going toward in his opinion, less than worthy occupations such as finance whose effects have been "massively negative."

Accordingly, if income inequality is predominately explained by rising marginal productivity of the educated then why are financiers, who are responsible for bringing the U.S. economy "to the brink of ruin.

Saez and Piketty argue that the "working rich" are now at the top of the income ladder in the United States and their wealth far out-paces the rest of the country.

Larry Bartels, a Princeton political scientist and the author of Unequal Democracy, argues that federal tax policy since 1964 and starting even before that has increased economic inequality in the United States.

Additionally, Bartels believes that the reduction and the temporary repeal of the estate tax also increased income inequality by benefiting almost exclusively the wealthiest in America.

[68] Public policy responses addressing causes and effects of income inequality include: progressive tax incidence adjustments, strengthening social safety net provisions such as Aid to Families with Dependent Children, welfare, the food stamp program, Social Security, Medicare, and Medicaid, increasing and reforming higher education subsidies, increasing infrastructure spending, and placing limits on and taxing rent-seeking.

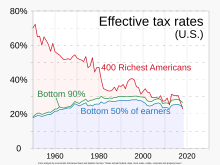

[70] The Congressional Budget Office reported that less progressive tax and transfer policies contributed to an increase in after-tax income inequality between 1979 and 2007.

[75][76][77] The Pew Center reported in January 2014 that 54% of Americans supported raising taxes on the wealthy and corporations to expand aid to the poor.

Their proposed legislation would prohibit buybacks unless the corporation has taken other steps first, such as paying workers more, providing more benefits such as healthcare and pensions, and investing in the community.

For instance, workers who face mobility constraints might benefit from upgraded public transportation systems, enabling them to commute to better-paying jobs that are located further away from their residences and to access essential services more affordably.

[91] Burkhauser et al. (2013) indicate that measured inequality is about 25 to 30 percent smaller if the average cost of Medicare and Medicaid benefits are added to recipients’ incomes.

Additionally, the budget directs savings from proposed Medicare drug reforms into the HI trust fund.The budget also invests in staff, information technology, and improvements at the Social Security Administration (SSA), aiming to enhance customer service at field offices, State disability determination services, and teleservice centers for retirees, individuals with disabilities, and their families.