Tax sale

Common requirements include: Once the process begins, the property owner can still avoid foreclosure by paying the amount owed plus interest, penalties, and/or other costs or fees.

Alternatively, the owner can file suit to have the sale set aside on grounds that the requirements were not followed (such as proper notice not given).

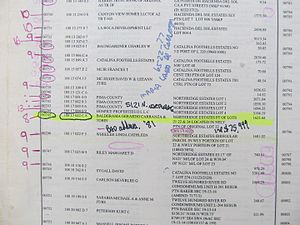

At the sale, the minimum bid is generally the amount of back taxes owed plus interest, as well as costs associated with selling the property.

However, the purchaser must follow each county's rules, which vary widely, and usually have a very short period (generally 48–72 hours, or much less) to pay the entire amount owed, or else the sale is invalidated and usually the auction deposit is lost.

[10] Usually the lien holder is not permitted during this period to contact the property owner (or anyone else having an interest in the property, such as the mortgage holder) to demand payment or threaten foreclosure, or else the lienholder can face sanctions (such as: termination of the lien and loss of money spent, being banned from future sales, and/or criminal charges).

[11] In some jurisdictions,[12] the lienholder must agree to pay subsequent unpaid property taxes during the redemption period in order to protect his/her interest.

During the period between the initiation of proceedings and actual foreclosure, the property owner still has the opportunity to repay the lien with interest plus the costs incurred to foreclose.

If the lienholder does not act within a specified period of time, as defined by state law, the lien is forfeited and the holder loses his investment.

This period of time cannot be extended unless the tax lien holder is officially in the process of foreclosing on the property or other legal action (such as bankruptcy) is pending.

Examples of such high returns include: The market in tax liens has been so popular that a number of major banks and hedge funds have invested large amounts of capital in it.