Taxation in Norway

According to the Norwegian Constitution, the Storting is to be the final authority in matters concerning the finances of the State - expenditures as well as revenues.

The Ministry of Finance sets up the government's tax program, which is included in the fiscal budget proposal.

In order to implement the tax program decided by the Storting, the Ministry of Finance is supported by two subordinate agencies and bodies.

Of the OECD member countries Denmark, Sweden, Belgium, Italy, France, Finland and Austria had a higher tax level than Norway in 2009.

[6] The relatively high tax level is a result of the large Norwegian welfare state.

[7] Revenue levels are also influenced by the important role played by oil and gas extraction in the Norwegian economy.

[8] No social security contribution is paid for income below the exemption card threshold (frikortgrense).

[14] The minimum standard deduction is set as a proportion of the income with upper and lower limits.

The lower limit is the so-called special wage income allowance (lønnsfradrag), which is NOK 31,800 in 2018.

When added to the 28% company taxation, this gives a total maximum marginal tax rate on dividends of 48.16% (0.28+0.72*0.28).

[16] The part of the dividend that is not exceeding a risk-free return on the investment, is not taxed on the hand of the shareholder, and is thus subject to the 28% company taxation only.

Furthermore, only the distributed profit exceeding a risk-free interest on the capital invested in the partnership will be taxable.

[15] The shielding method for self-employed individuals (skjermingsmetoden for enkeltpersonforetak or foretaksmodellen) implies that business profits exceeding a risk-free interest on the capital invested is taxed as personal income (the tax base for social security contributions and surtax).

The employers' social security contribution are regionally differentiated, so that the tax rate depends on where the business is located.

[18] When the employers' social security contribution is included, the maximum marginal tax rate on labour costs is 53.2%.

In addition, the profit is taxed on the owner's hand through dividend and capital gain taxation.

[27] As a consequence of basic deduction in combination with gentle assessment rules, especially of housing, the wealth tax is of little importance to most tax-paying households.

From this level, the rates ranged from 6% to 15% depending on the status of the beneficiary and the size of the taxable amount.

[35] Excise duties (Norwegian: særavgifter) are taxes levied on particular goods and services, of foreign or domestic origin.

The ordinary rate of the Customs Tariffs applies for goods imported from countries with whom Norway has not entered into a free trade agreement (FTA), and for goods imported from a FTA-party, but not satisfying by the conditions for preferential tariff treatment as set out in these agreements.

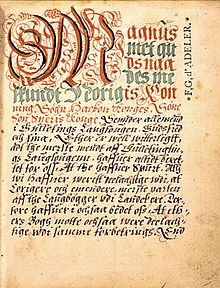

This was originally a defensive scheme where all armed men would meet and fight for their king when peace was threatened, but in Norway the leidang evolved to primarily be a naval defence.

The agreement between the king and his people must from the beginning have included a crew arrangement and an outfitting and provisioning system.

The most important regular, often annual burden for the population, must have been the dietary performance to the crew of the leidang fleet.

The church had significant tax revenues in the form of tithe which became law over most of the country in Magnus Erlingson's days (1163-1184).

The tax was levied on the land register in the villages and mainly on income and economic activity in cities.

Taxes were paid directly to the various funds that were responsible for financing and operating various types of municipal services.

These tax bases, however, was too narrow to cover the growth in government expenditure at the end of the 19th century.

Excises became even more important during the World War I when taxes on tobacco and motor vehicles were introduced.

Corporate taxation was designed so that the taxable profit should correspond to the actual budget surplus.

This meant, among other things that different industries, forms of ownership, financing methods and investment were treated equally (neutrality) and that revenues and related expenditures were subject to the same tax rate.

National Archival Services of Norway