Taxation of private equity and hedge funds

They are subject to favorable regulatory treatment in most jurisdictions from which they are managed, which allows them to engage in financial activities that are off-limits for more regulated companies.

Because the 20% profits share typically is the bulk of the manager's compensation, and because this compensation can reach, in the case of the most successful funds, enormous figures, concern has been raised, both in Congress and in the media, that managers are taking advantage of tax loopholes to receive what is effectively a salary without paying the ordinary 39.6% marginal income tax rates that an average person would have to pay on such income.

2834, which would eliminate the ability of persons performing investment adviser or similar services to partnerships to receive capital gains tax treatment on their income.

A line item on taxing carried interest at ordinary income rates was included in the Obama Administration's 2008 Budget Blueprint.

[12] To address what they viewed as a loophole in the law, Senators Baucus and Grassley introduced S. 1624, which would remove the ability for publicly traded partnerships performing asset-management and related services to avoid being taxed as corporations.

[7] The House extenders package included a carried interest provision that would apply to publicly traded partnerships beginning in tax years after 31 December 2009.

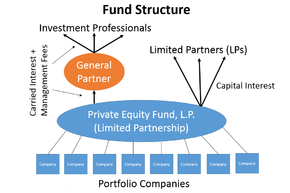

In particular, foreign investors and domestic tax-exempt organizations both have reasons to prefer to interpose a corporation in the private equity or hedge fund structure.

[4] Foreign investors are generally not required to file tax returns unless they have “effectively connected income,” derived from the active conduct of a U.S. trade or business.

To avoid this requirement, a foreign investor will often invest through a blocker corporation (usually located in the Cayman Islands or another offshore jurisdiction).

[4] To date, no bill has been introduced to change this treatment, although concerns over the tax gap have led to increased scrutiny of business structures involving offshore corporations in general.