Bank of England

[33] As he later wrote in his pamphlet A Brief Account of the Intended Bank of England (1694): "...it was proposed some years ago that a publick transferrable Fund of Interest should be established by Parliament, and made convenient for the Receipts and Payments in and about the Cities of London and Westminster; and to constitute a Society of Money'd Men for the government thereof, who should be induced by their Interest to exchange for Money the Assignments upon the Fund, at every demand".

[26] It has also been claimed (by W. R. Scott, among others)[35] that William Phips played a timely, if incidental, role: his successful expedition to retrieve booty from a sunken Spanish galleon (the Nuestra Señora de la Concepción) helped create an ideal market for the bank's foundation: flooding the market with bullion and creating an enthusiasm for joint-stock ventures.

[41] King William and Queen Mary (jointly) invested £10,000, the maximum permitted sum, as did a handful of others (including Sir John Houblon).

)[26] The Act of Parliament prohibited the bank from trading in goods or merchandise of any kind, though it was allowed to deal in gold and silver bullion, and in bills of exchange.

[49] In 1700, the Hollow Sword Blade Company was purchased by a group of businessmen who wished to establish a competing English bank (in an action that would today be considered a "back door listing").

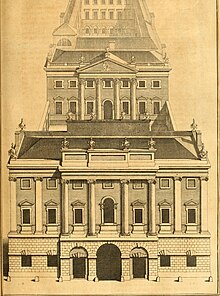

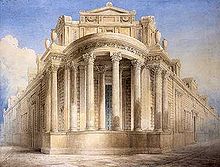

[51] The Bank of England moved to its current location, on the site of Sir John Houblon's house and garden in Threadneedle Street (close by the church of St Christopher le Stocks), in 1734.

)[47] The newly built premises, designed by George Sampson, occupied a narrow plot (around 80 feet (24 m) wide) extending north from Threadneedle Street.

[53] Beneath the quadrangle were the vaults ('that have very strong Walls and Iron Gates, for the Preservation of the Cash'); access to the courtyard was provided, by way of a passage leading to a 'grand Gateway' on Bartholomew Lane, for the coaches and waggons 'that come frequently loaded with Gold and Silver Bullion'.

[54] The pediment above the entrance to the main Hall was decorated with a carved alto relievo figure of Britannia (who had appeared on the common seal of the bank since 30 July 1694);[57] the sculptor was Robert Taylor, who went on to be appointed Architect, in succession to Sampson, in 1764.

During the riots, in June 1780, the Lord Mayor of London petitioned the Secretary of State to send a military guard to protect the bank and the Mansion House.

To house the guard Taylor built a barracks (accessed from a separate entrance on Princes Street) in the north-west corner of the site.

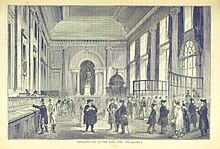

[64] In the late 18th and early 19th century, prior to the establishment of the London Stock Exchange, the Rotunda in the Bank of England was used as a trading floor 'where stock-brokers, stock-jobbers, and other persons, meet for the purpose of transacting business in public funds'.

Its soldiers were trained, in the event of an invasion, to remove the gold and silver from the vaults to a remote location, along with the banknote printing presses and certain important records.

At the start of the 19th century a plan was enacted by John Soane for the further extension of the bank's premises, this time to the north-west (necessitating the rerouting of Princes Street, to form the new western boundary of the site).

In 1811, an 'ingeniously contrived clock' by Thwaites & Co. was installed above the Pay Hall:[72] as well as chiming the hours and quarters, it conveyed the time remotely (by means of brass rods extending a total of 700 feet (210 m) in length) to dials located in sixteen different offices around the site.

A later Governor, Robin Leigh-Pemberton, described it as 'a time of rapid change, in which we began to move away from the clerical traditions of 200 years [...] and to accept specialisation, mechanisation and modern management disciplines'.

In 1931 the 'Peacock Committee', set up to advise on organisational improvements, published recommendations which included the appointment of paid executive Directors (alongside the traditional non-executive members of the Court).

During reconstruction human remains pertaining to the old churchyard of St Christopher le Stocks were exhumed and reburied at Nunhead Cemetery.

[84] A number of the bank's operations and staff were relocated to Hampshire for the duration of the war, including the printing works (which moved to Overton), the Accountant's Department (which went to Hurstbourne Park) and various other offices.

The department was instead provided with temporary accommodation (once more in Finsbury Circus), pending construction of a new building, which would occupy a two-acre bombsite immediately to the east of St Paul's Cathedral.

'Bank of England New Change' was designed by Victor Heal and opened in 1957 (at the time it was London's biggest post-war rebuilding project);[86] the new building contained several staff amenities alongside the office accommodation and, at street level, retail units were let to an assortment of businesses.

The UK government left the expensive-to-maintain European Exchange Rate Mechanism in September 1992, in an action that cost HM Treasury over £3 billion.

[84] On 6 May 1997, following the 1997 general election that brought a Labour government to power for the first time since 1979, it was announced by the Chancellor of the Exchequer, Gordon Brown, that the bank would be granted operational independence over monetary policy.

This change in Labour's politics was described by Skidelsky in The Return of the Master[101] as a mistake and as an adoption of the rational expectations hypothesis as promulgated by Alan Walters.

[102] Inflation targets combined with central bank independence have been characterised as a "starve the beast" strategy creating a lack of money in the public sector.

[17] At the start of the First World War, the Currency and Bank Notes Act 1914 was passed, which granted temporary powers to HM Treasury for issuing banknotes to the values of £1 and 10/- (ten shillings).

The original plan was to parachute the money into the UK in an attempt to destabilise the British economy, but it was found more useful to use the notes to pay German agents operating throughout Europe.

Although most fell into Allied hands at the end of the war, forgeries frequently appeared for years afterward, which led banknote denominations above £5 to be removed from circulation.

The first branches opened in 1826 (with impetus provided by the passing of the Country Bankers Act, which for the first time permitted the establishment of joint-stock banks outside London).

[121] Following is a list of the governors of the Bank of England since the beginning of the 20th century:[122] The Court of Directors is a unitary board that is responsible for setting the organisation's strategy and budget and making key decisions on resourcing and appointments.