Balance of trade

The discrepancy is widely believed to be explained by transactions intended to launder money or evade taxes, smuggling and other visibility problems.

In export-led growth (such as oil and early industrial goods), the balance of trade will shift towards exports during an economic expansion.

[citation needed] However, with domestic demand-led growth (as in the United States and Australia) the trade balance will shift towards imports at the same stage in the business cycle.

[10] An early statement concerning the balance of trade appeared in Discourse of the Common Wealth of this Realm of England, 1549: "We must always take heed that we buy no more from strangers than we sell them, for so should we impoverish ourselves and enrich them.

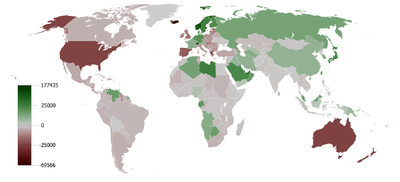

[12] Since the mid-1980s, the United States has had a growing deficit in tradeable goods, especially with Asian nations (China and Japan) which now hold large sums of U.S. debt that has in part funded the consumption.

[23][2][3][4][5] According to the IMF trade deficits can cause a balance of payments problem, which can affect foreign exchange shortages and hurt countries.

[24] On the other hand, Joseph Stiglitz points out that countries running surpluses exert a "negative externality" on trading partners, and pose a threat to global prosperity, far more than those in deficit.

[30] In the foregoing part of this chapter I have endeavoured to show, even upon the principles of the commercial system, how unnecessary it is to lay extraordinary restraints upon the importation of goods from those countries with which the balance of trade is supposed to be disadvantageous.

He was the leader of the British delegation to the United Nations Monetary and Financial Conference in 1944 that established the Bretton Woods system of international currency management.

The two governing principles of the plan were that the problem of settling outstanding balances should be solved by 'creating' additional 'international money', and that debtor and creditor should be treated almost alike as disturbers of equilibrium.

In the event, though, the plans were rejected, in part because "American opinion was naturally reluctant to accept the principle of equality of treatment so novel in debtor-creditor relationships".

In the words of Geoffrey Crowther, then editor of The Economist, "If the economic relationships between nations are not, by one means or another, brought fairly close to balance, then there is no set of financial arrangements that can rescue the world from the impoverishing results of chaos.

For example, the second edition of the popular introductory textbook, An Outline of Money,[41] devoted the last three of its ten chapters to questions of foreign exchange management and in particular the 'problem of balance'.

[43] Prior to 20th-century monetarist theory, the 19th-century economist and philosopher Frédéric Bastiat expressed the idea that trade deficits actually were a manifestation of profit, rather than a loss.

By reductio ad absurdum, Bastiat argued that the national trade deficit was an indicator of a successful economy, rather than a failing one.

In the 1980s, Friedman, a Nobel Memorial Prize-winning economist and a proponent of monetarism, contended that some of the concerns of trade deficits are unfair criticisms in an attempt to push macroeconomic policies favorable to exporting industries.

Since 1971, when the Nixon administration decided to abolish fixed exchange rates, America's Current Account accumulated trade deficits have totaled $7.75 trillion as of 2010.

In the late 1970s and early 1980s, the U.S. had experienced high inflation and Friedman's policy positions tended to defend the stronger dollar at that time.