Two-sided market

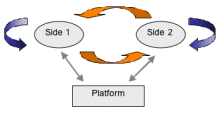

The organization that creates value primarily by enabling direct interactions between two (or more) distinct types of affiliated customers is called a multi-sided platform.

[1] This concept of two-sided markets has been mainly theorised by the French economists Jean Tirole and Jean-Charles Rochet and Americans Geoffrey G Parker and Marshall Van Alstyne.

Example markets include credit cards (composed of cardholders and merchants); health maintenance organizations (patients and doctors); operating systems (end-users and developers); yellow pages (advertisers and consumers); video-game consoles (gamers and game developers); recruitment sites (job seekers and recruiters); search engines (advertisers and users); and communication networks, such as the Internet.

Examples of well known companies employing two-sided markets include such organizations as American Express (credit cards), eBay (marketplace), Taobao (marketplace in China), Facebook (social medium), LinkedIn (professional media), Mall of America (shopping mall), Match.com (dating platform), AIESEC (leadership development for youth by placing talent in companies), Monster.com (recruitment platform), and Sony (game consoles).

Same-side network effects may be either positive (e.g., the benefit from swapping video games with more peers) or negative (e.g., the desire to exclude direct rivals from an online business-to-business marketplace).

This network effect present the agency relationship between buyers and seller, and the platform need to alter compensation properly to satisfy both parties.

Merchants require terminals for authorizing transactions, procedures for submitting charges and receiving payment, "signage" (decals that show the card is accepted), etc.

In the operating systems market for home computers, created in the early 1980s with the introduction of the Macintosh and IBM PC, Microsoft decided to steeply discount the software development toolkit (SDKs) for its operating system, relative to Apple pricing at that time, lowering the barrier to entry to the home computer market for software businesses.

In traditional businesses, growth beyond some point usually leads to diminishing returns: Acquiring new customers becomes harder as fewer people, not more, find the firm's value proposition appealing.

Platform leaders can leverage their higher margins to invest more in R&D or lower their prices, driving out weaker rivals.

In extreme situations, such as PC operating systems, a single company emerges as the winner, taking almost all of the market.

As illustrated in figure 3, giving consumers a free reader created demand for the document writer, the network's "money side".

Free-PC incurred $80M in losses in 1999 when it decided to give away computers and Internet access at no cost to consumers who agreed to view Internet-delivered ads that could not be minimized or hidden.

While Apple initially tried to charge both sides of the market, like Adobe did in figure 2, Microsoft uncovered a second pricing rule: subsidize those who add platform value.

In the case of color TV, CBS and RCA offered rival formats but initially neither gained market traction.

RCA also subsidized Walt Disney's Wonderful World of Color, which gave consumers reason to buy the new technology.

Instances arise, for example, when consumers carry credit cards from more than one banking network or they continue using computers based on two different operating systems.

This condition implies an increase of "homing" costs, which comprise all the expenses network users incur in order to establish and maintain platform affiliation.

Higher multihoming costs reduce user willingness to maintain affiliation with competing networks providing similar services.

Attracted by the prospects of large margins, platforms can try to compete to be the winner-take-all in two-sided markets with strong network effects.

These regulatory authorities try to determine the marginal cost and demand for these markets in order to establish the socially optimal price.

The benefits of compatibility and collaboration were realized early on which led to the formation of networks that served groups of banks.

The last option when facing envelopment is to resort to legal remedies, since antitrust law for two-sided networks is still in dispute.