Insurance cycle

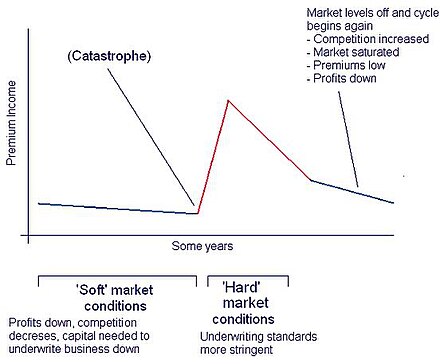

The underwriting cycle is the tendency of property and casualty insurance premiums, profits, and availability of coverage to rise and fall with some regularity over time.

[1] For example, Lloyd's Franchise Performance Director Rolf Tolle stated in 2007 that "mitigating the insurance cycle was the "biggest challenge" facing managing agents in the next few years".

Most commentators believe that underwriting cycles are inevitable, primarily "because the uncertainty inherent in matching insurance prices to [future] losses creates an environment in which the motivations, ambitions, and fears of a complex cast of characters can play out.

[4] More recently, insurers have attempted to model the cycle and base their policy pricing and risk exposure accordingly.

The next stage is precipitated by a catastrophe or similar significant loss, for example Hurricane Andrew or the attacks on the World Trade Center.