Wells Fargo (1852–1998)

Undaunted, Wells and Fargo decided to start their own business while continuing to fulfill their responsibilities as officers and directors of American Express.

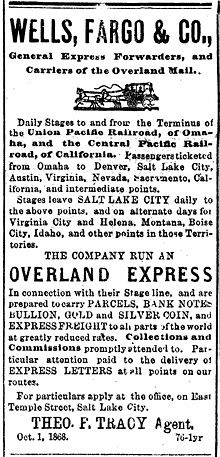

Under Barney's direction, the company developed its own stagecoach business, helped start and then took over Butterfield Overland Mail, and participated in the Pony Express.

By the end of 1860, the Pony Express was in deep financial trouble; its fees did not cover its costs and, without government subsidies and lucrative mail contracts, it could not make up the difference.

After Overland Mail, by then controlled by Wells Fargo, was awarded a $1 million government contract in early 1861 to provide daily mail service over a central route (the American Civil War had forced the discontinuation of the southern line), Wells Fargo took over the western portion of the Pony Express route from Salt Lake City, Utah to San Francisco.

Barney resigned as president of Wells Fargo to devote more time to his own business, the United States Express Company; Louis McLane replaced him when the merger was completed on November 1, 1866.

Although the Central Pacific Railroad, already operating over the Sierra Mountains to Reno, Nevada, carried Wells Fargo's express, the company did not have an exclusive contract.

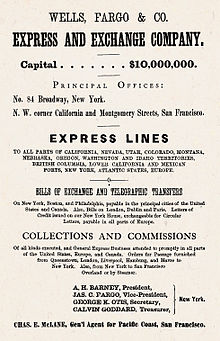

[25][26] Until 1876, both banking and express operations of Wells Fargo in San Francisco were carried on in the same building at the northeast corner of California and Montgomery Streets.

[31][[[Levi Strauss#{{{section}}}|contradictory]]] Evans was president of Wells Fargo & Company Express until his death in April 1910 when he was succeeded by William Sproule.

The 1906 San Francisco earthquake and fire destroyed most of the city's business district, including the Wells Fargo Nevada National Bank building.

[39] A year later Cooley enticed Ernest C. Arbuckle, dean of the Stanford Graduate School of Business, to join Wells Fargo's board as chairman when Chase retired in January 1968.

Wells Fargo could now use its name in any area of financial services it chose (except the armored car trade—those rights had been sold to another company two years earlier).

To meet the demand for credit, the bank frequently borrowed short-term from the Federal Reserve to lend at higher rates of interest to businesses and individuals.

In January 1981, the banking community was shocked to learn that a routine audit by the Assistant Operations Officer of the Wells Fargo Miracle Mile branch, Judith Allyn MacLardie, had revealed a $21.3 million embezzlement scheme.

During 1978–1981, Lewis had colluded with a former employee of the Miracle Mile branch, Muhammed Ali Professional Sports, Inc. (MAPS) president Sam "Sammie" Marshall, to defraud the bank.

Lewis, who was also listed as a director of MAPS, successfully wrote phony debit and credit receipts to benefit the boxing promotional company and its founder and chairman, the eventually infamous Harold J. Smith (né Ross Eugene Fields).

In excess of $300,000 was paid to Lewis for the fraud, who pled guilty to embezzlement and conspiracy charges, and testified against his MAPS co-conspirators for a reduced five-year sentence.

[44][45][46] Wells Fargo CEO and chairman Richard P. "Dick" Cooley (November 25, 1923 – September 22, 2016), who resigned his post in late 1982,[47] was quoted in 1981, remarking that Lewis had "carried out a 'brilliantly simple' scheme that cracked the bank's auditing system.

September 1983 marked the date of the White Eagle Robbery when the Wells Fargo depot in West Hartford, Connecticut was robbed by members of the pro-Puerto Rican independence guerilla group Boricua Popular Army (Los Macheteros) in what was then the "largest cash heist in U.S. history".

The perpetrators were apprehended by the Federal Bureau of Investigation and two were sentenced to jail terms of 55 and 65 years while another suspect has been on the FBI Ten Most Wanted Fugitives list since 1984.

During the three years before the acquisition, Wells Fargo sold its realty-services subsidiary, its residential-mortgage service operation, and its corporate trust and agency businesses.

In 1987, Wells Fargo set aside large reserves to cover potential losses on its Latin American loans, most notably to Brazil and Mexico.

In an opinion by Acting Presiding Justice William Newsom, the court held that Wells Fargo was not subject to tort liability for breach of the implied covenant of good faith and fair dealing just because it had taken a "hard-line" approach in negotiations with its borrowers, and refused to modify or forbear enforcing the terms of the relevant promissory notes.

[54] The borrowers had narrowly avoided foreclosure only by liquidating a large number of assets at fire sale prices to raise cash and pay off their loans in full.

The bank began selling stamps through its automated teller machines (ATMs), for example, and in 1995 was partnering with CyberCash, Inc., a software startup company, to begin offering its services over the Internet.

At the end of 1994, after 12 years of service during which Wells Fargo & Co. investors enjoyed a 1,781% return, Reichardt stepped aside as head of the company and was succeeded by Hazen.

Even though American Express was going through a very expensive and ambitious technological upgrade, it still would have lagged greatly behind Wells Fargo's systems, posing tremendous integration risk.

[citation needed] Late in 1995, Wells Fargo began pursuing a hostile takeover of First Interstate Bancorp, a Los Angeles-based bank holding company with $58 billion in assets and 1,133 offices in California and 12 other western states.

Wells Fargo aimed to generate $800 million in annual operational savings out of the combined bank within 18 months, and immediately upon completion of the takeover announced a workforce reduction of 16 percent, or 7,200 positions, by the end of 1996.

Although Norwest was the nominal survivor, the merged company retained the Wells Fargo name because of the latter's greater public recognition and the former's regional connotations.

Rather than the hasty mass layoffs that were typical of many mergers, Wells Fargo announced a phased workforce reduction of 4,000 to 5,000 employees over a two-year period.